I think economic issues are the real drivers of American and the world, and sadly, they’re hardly reported on at all. Even NBC News, which has Andrea Mitchell reporting – the wife of former Federal Reserve Chairman Alan Greenspan – won’t seriously report what’s happening in the world.

Why is that? Well, it’s because that isn’t news you’re watching each evening around dinnertime, it’s propaganda. It’s propaganda designed by corporate writers so that you’ll feel safe, secure, and at ease enough to keep going out to put your money into the local economy. The last thing they want is for you to start saving money again. Considering interest rates have artificially been kept at 0% for more than 7.5 years, this isn’t likely to happen.

So what is really going on in the world? In this post we’ll take a look at several key economic indicators. They caused me quite a bit of alarm when I heard Gerald Celente talking about them last night on the radio. They should alarm you as well.

#1 Sending Jobs Overseas

You see a lot with H1-B visas, things that allow foreign workers to come in and take American jobs. Employers in Montana are getting excited about that as well, but the state has done it before, with Mexicans and Germans brought in during the 1920s to work the sugar beet fields, driving down wages and driving out native workers.

America has lost 3.2 million jobs since 2001, according to a December 2014 USA Today article, and two-thirds of them were manufacturing. We’ve lost more than 42,000 factories during that time. There were 19.5 million manufacturing workers in 1979 in America, but by 2009 there were 11.5 million. Unions of course took a hit, if they didn’t disappear altogether. The ability to bargain for wages, benefits, and pensions was all lost. Most workers, if they were lucky enough to get retirement, had it thrown into a market-based account called a 401(k) that’s prone to the vagaries of the market. Many of the accounts are empty, and if people do have 401(k) money, it’s less than $100,000 on average.

#2 Destabilized and Empty Pension Funds

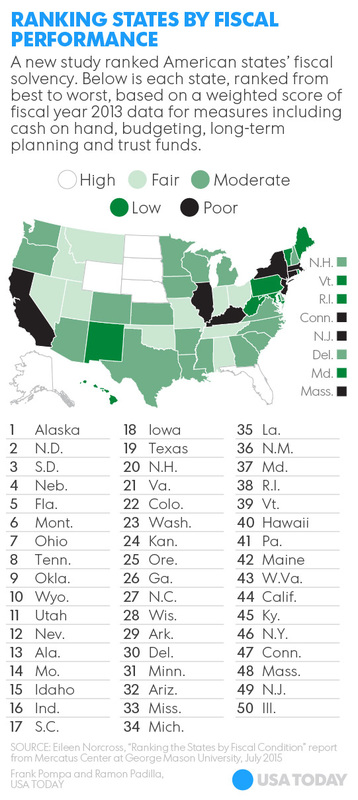

Something else that we know is states are very different. USA Today reported on July 7 that eastern states have all kinds of pension obligation problems, and states out west are doing better. That’s not quite accurate, however, as it’s the energy states that are really the ones on sound financial footing.

#3 Rigging of the Markets

- Citicorp;

- JPMorgan Chase;

- Barclays;

- Royal Bank of Scotland.

Swiss-bank UBS was also involved, but since they ratted out the others, they won’t face prosecution. It’s also likely that after appeals, campaign contributions, and other glad-handing and back rubbing, the banks will walk away having paid only a few million.

Markets are being rigged and our retirees’ pension funds depend on sound markets. Perhaps that’s why they’re being rigged, huh? After all, if our pension funds collapsed, we’d have tons of retirees not getting their monthly check and not putting money into their local economy. These people can’t work anymore, so it’d be a real nightmare. We also don’t have enough money in our food stamp fund, so doling out what’s needed won’t even be feasible.

#4 Sending Gold Overseas

The country is a mess. We were taken off the gold standard by Nixon as a way to cover up our Vietnam War debt. We just wiped that debt right off the books, and who could argue? We were the most powerful country in the world back then, Russia was behind the Iron Curtain, and China was still in the midst of the Cultural Revolution.

Jimmy Carter was the one that changed our usury laws with the Monetary Control Act of 1980 so debt could earn more interest. When we had the recessions after Reagan signed the Garn-St. Germain Depository Institutions Act in 1982, allowing adjustable-rate mortgages, they were a walk in the park compared to today. The reason for this is that we still had an economy based on reality, where the market could correct itself.

That all ended after the Savings and Loan Scandal in 1987. Alan Greenspan went ahead and started the trend of printing up money, and we haven’t stopped. The Dot Com Bust came in 1999 and then we had 9/11 a short time later. Interest rates were moved to 0% and have stayed there ever since.

The economy isn’t real anymore, and hasn’t been for some time. I can’t wait to release my latest volume of Montana history, for it tells the tale of FDR taking us off the gold standard in 1933, and also the federal confiscation of gold. The feds forced people to sell at $22 and ounce and then when they thought they’d had it all they raised the price to $35 an ounce. Back then the dollar was pegged to gold, so it was economic manipulation, big time. But again, who could stop them? Fort Knox needed its gold.

Today America doesn’t have that power. Instead it’s places like the European Central Bank and the new China Asian Investment Bank, although that might not get going as well as people had hoped with their stock market problems. Hey, at least they have gold, and lots of it.

America just has problems.

#5 American Spending Priorities

What a waste of money, and we’re not even getting into the $94 billion slush fund the Pentagon currently has to play around with. That money should be taken away to fix our roads and bridges and we can go from there. There used to be a time when fixing this nation was a good idea, and it was called the New Deal. It made this country strong, but now we’ve abandoned the principles that made us and embraced those which brought us to our knees.

The American economy is a mess, and we’ll experience austerity soon, just like Greece. No one wants to say this, and if you do, you’re labeled as a nutcase.

#6 The Greece Meltdown

The country is taking on more debt, $93 billion worth over the next three years, or $31 billion a year. That puts Greece’s total debt at 200% of the country’s GDP.

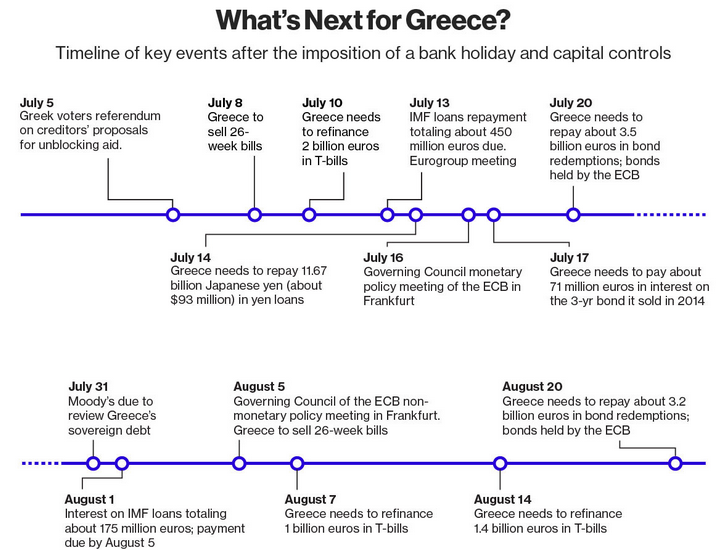

The whole reason we’re seeing this come about is because of the July 20 deadline that was fast approaching. This called for a $4.6 billion payment to the European Central Bank. There was really no way that could be paid without getting that new stimulus money. So it’s like someone with credit card debt taking out a new credit card just to make payments on the old one. We’re not even talking about paying anything off at this point, and you know this new debt is going to have a higher interest rate attached. Don’t think this July 20 deadline is unique, either – there’s another one coming up on August 20, and I expect they’ll follow a similar patter throughout the year.

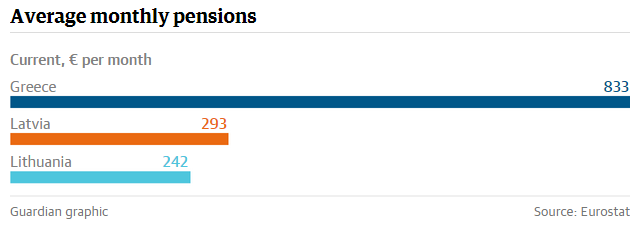

Average monthly pensions in Greece are €833, while in Lithuania its €242. This graph shows that well:

The place where Democracy was born has seen its Democratic voting power become meaningless. The country has no power, they have no sovereignty.

Why would anyone want to join the European Union? No one would. Right now they’re talking about the thing falling apart, and something you hear a lot is that they’re “kicking the can down the road.” At some point, the debt will come due.

#7 Other EU Countries Facing Problems

Portugal has always been shaky. They were bailed out in 2011 by the EU to the tune of €78 billion. They made it back to the bond markets in 2014, meaning they could borrow more money, just like a degenerate gambler crawling back to the slot machine. Their debt-to-GDP ratio is still “more than 120%, so you know they’ll have problems paying for essential services and eventually pensions.

Cyprus required €10 billion in aid in 2013. Those with more than €100,000 in the bank “bailed in” the banks, essentially losing money they’d had in the banks. You can probably guess that few professionals or other high earners would want to live there. That’s the terrible cycle many of these countries face – turning off all future business so they’ll always be dependent. Many will become frustrated, and that’s how wars start.

#8 Debt in America’s Back Yard

There’s little that can be done in the case of Puerto Rico – it’s not a country and can’t get help from the IMF. That’s why Congress is trying to get some Chapter 9 bankruptcy protection through to the island. It’s expected to take awhile, and meanwhile the territory has another debt payment coming up soon.

It’s not just in our back yard, either. The national debt for America was $18,608,793,280,000 last night as I was preparing this article.

Yes, that’s $18.6 trillion.

I know you’re surprised, because a few months a go we were all saying $17 trillion. Hell, I’m still saying $17 trillion most of the time, and by the time I finally catch up and start saying $18 trillion, we’ll already be up to $19 trillion. Shit.

#9 Interest Rates: Hikes in America, Negatives in Europe

We keep hearing this talk of raising interest rates, but it never happens. We’ve had 93 months of zero-interest rate policy, nearly a decade. This hurts regular people, workers. We used to have savings accounts that you could put money in and actually make money. Those days are now in the history books.

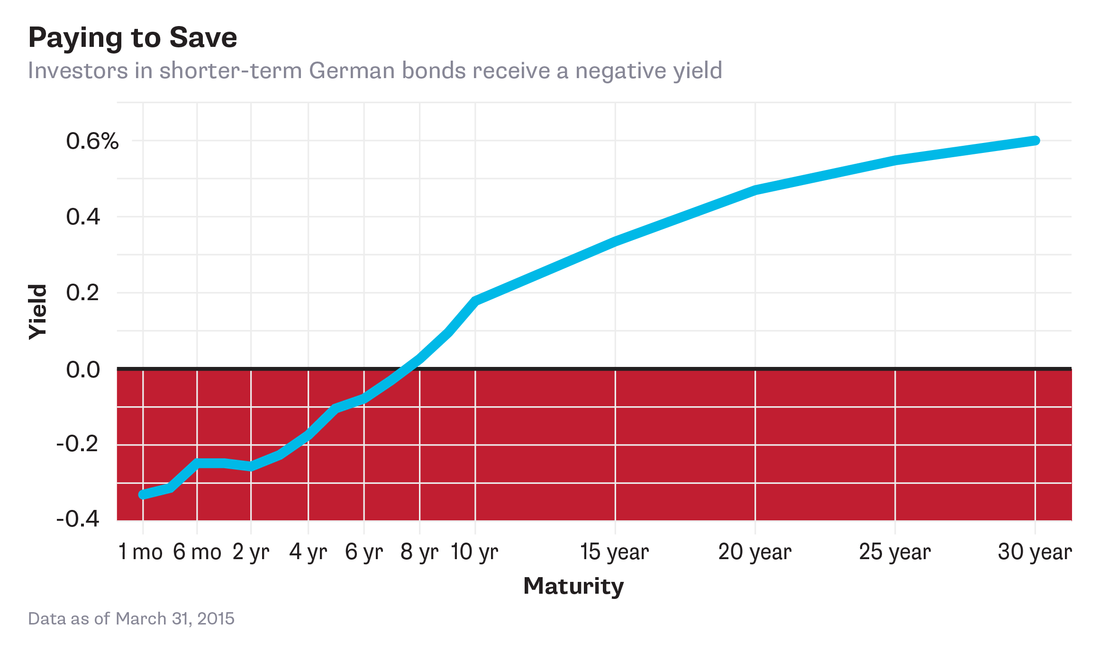

Hey, at least we’re not Europe where interest rates are negative. Yep, you pay the bank to keep your money. Negative yields – yippee!

On August 6 interest rates are likely to go up, but not by much. Just keep looking at the commodity prices, the natural resources that we have. Look at the economic indicators.

- China is gobbling up half our exports, but they’re slowing down their pace They’re stock market is stumbling as the property market corrects itself.

- Iron ore was at $191 in 2011 and now its $60.

- Copper went to a 6-year low following Yellen’s comments yesterday.

- Canada is slashing its benchmark rate 0.5%. They’re heading toward a recession because the commodity prices are slumping.

- The Australian dollar is going down, the Canadian dollar is the lowest since 2009.

- Chile’s major export is copper so that country is being destabilized.

- Angola, Congo, and other natural resource countries are going to explode, because without the money, they can’t keep the lid on their domestic problems.

- Brazil is in a huge recession, all while trying to borrow for the Olympic construction.

What a mess.

#10 The Political Contest of Fakery

Small businesses around the country are getting hurt, but we never talk about these economic issues. Republicans love talking about social issues that get people excited. Democrats will just take the opposite side, and the political theatre can begin.

The international bankers have already chosen Hillary. Like I said in the MT Cowgirl comments yesterday, her top adviser was at Bilderberg – she’s the anointed one. That’s good, because women love her, and that alone means she’ll be president.

Hillary has 60% of her money coming from women voters. The Republican candidates and the issues they have, there’s no way they can stand up against half the electorate abandoning them. Obama got a lot more women voters than Romney. And really, which husbands are going to risk alienating their wives by arguing against their vehement support for Hillary? If they want to keep getting some on Saturday night, that’s not likely to happen. We certainly know the makers of Viagra couldn’t afford the flagging sales performance that might bring about.

Never forget that people like Hillary and all the rest of the candidates are the people you couldn’t stand in high school. Many of these folks are sociopaths that can’t function correctly in the real world, have thin skins that won’t stand criticism, and refuse to listen to any thinking but their own. The country’s seen what these people have done – you’ve just read it – and it can’t afford anymore.

Remember, the price of freedom is eternal vigilance. The price of eternal vigilance is indifference.

Remain vigilant.

You Might Also Like

Why is Healthcare Killing Us? (April 19, 2015)

10 Ways the Federal Government Wastes Money (Dec 11, 2014)

The Rothschilds, Illuminati, and Freemasons (June 3, 2015)