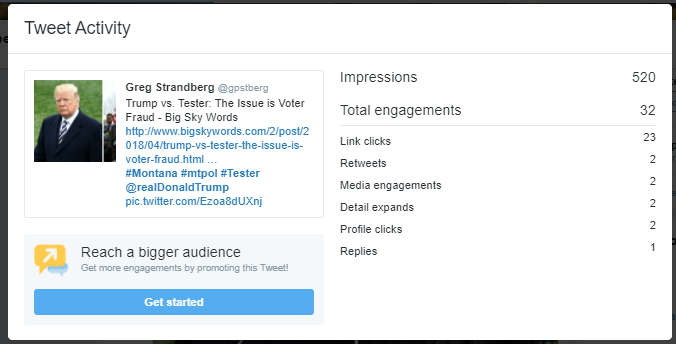

I was mainly interested to see how well yesterday’s post did.

Pretty dang well, I think, with 23 people clicking on that link.

I felt pretty good…but then a few moments later I felt pretty bad.

You see, I got this tweet from Jeff Essman:

This is going to drive @gpstberg WILD. And he told you so. #mtpol https://t.co/aVCmj6tU2I

— Jeff Essmann (@EssmannJeff) April 30, 2018

What the hell is he talking about? I decided to click onto the tweet he was retweeting, and it turns out it’s a story from Roll Call.

Bank Group Plans Midterm Ads, Starting With Tester, Budd.

“Bank group,” eh?

I missed this one, probably because it came out last Wednesday, when Tester was more in the news for his comments on Admiral Jackson.

It turns out the American Bankers Association will “weigh into midterm congressional campaigns for the first time with independent expenditure TV ads.”

They’ll start off with “six figure” ad buys here in Montana, and in North Carolina, where Republican Ted Budd is from.

That’s kind of an interesting angle to this story – the same banking cartel is giving the exact same amounts to both a Democrat and a Republican.

Roll Call calls Tester a “co-sponsor and vocal supporter of the Senate’s banking deregulation bill.”

One of the key words there is “deregulation.”

You might remember that Tester’s impetus for running for the legislature back in ’98 was because of deregulation here in Montana, specifically the disastrous policies that were applied to our energy industry.

So 20 years ago, Tester wasn’t a fan of deregulation. Now, however, he is.

It sounds like these banking cartel ads will start up on May 2. Anyone who has a TV knows damn-well that Tester already has a bunch of ads running. People are probably already getting sick of ‘em.

“Tester’s involvement in crafting the banking deregulation bill” is the main reason the banking cartel is supporting him.

That bill passed in March, 67 to 31 in the Senate, with 16 Democrats joining 50 Republicans and 1 Independent to get the job done.

Many Democrats opposed the bill, and they were vocal in their displeasure. Even Montana’s most Democratic blog claimed those critics had “political reasons to make hay over reform of Dodd-Frank.”

Tester’s main reason for supporting this bill was that it would “exempt small banks from some requirements for loans, mortgages, and trading, among other measures.”

Tester says this will help the small, Montana community banks.

I don’t think this adds up.

The previous Dodd-Frank bill, which passed in 2010, set a Federal Reserve oversight threshold of $50 billion in assets.

That’s a lot of money!

Now, however, banks won’t be scrutinized unless they have $250 billion in assets.

Even Barney Frank – one of the 2010 crafters of the original bill – is saying that this threshold is too high. He points out that one of the central figures of the 2008 mortgage crisis was Countrywide Financial, which at that time had assets of $210 billion.

We should have been keeping a closer eye on banks like that 10 years ago, and we probably should be doing the same today. Now we’ve ensured that we won’t be doing that at all.

Two more troubling aspects of Tester’s banking bill are the facts that it allows “foreign megabanks” to put “their American assets into a separate holding company to avoid US regulatory scrutiny” and also that it “weakens anti-discrimination standards in housing by raising the number of loans a bank can make before it’s required to report on the issue.”

But back to the smaller banks, which was Tester’s rationale for co-sponsoring this.

Like I said, this just doesn’t add up. You can see this clearly when you look at the largest banks in Montana:

- First Interstate Bank: $12.1 billion in assets

- Glacier Bank: $9.6 billion in assets

- Stockman Bank of Montana: $3.5 billion in assets

- First Security Bank: $1 billion in assets

- The Yellowstone Bank: $722 million in assets.

As you can see, our Montana banks don’t even come close to either the previous $50 billion threshold, or the newer, $250 billion threshold.

In total, Montana has 59 local and national banks spread over 117 cities, with 354 branches between them all.

Might sound like a lot, but a hundred years ago we had over 400 banks in the state. Between 1920 and 1926, however, we saw 214 of them fail. In fact, 191 of them closed in 1924 alone!

The reason? Mortgage debts that farmers just couldn’t pay to the banks. Remember, half the people in the state lost their land and/or homes during those years, 20,000 in all. Some figure the state lost 20% of its population during this time, or 60,000 people.

So really, we need to keep an eye on our banks in this state. Our history makes this clear.

In today’s world, First Interstate Bank might have more assets, but Glacier Bank has more offices: 43 to 45, respectively.

Wells Fargo has 40 offices in the state, making it the third-largest bank in physical size in the state.

When it comes to assets, however, they have $1.9 trillion in assets. This is also a bank that has been convicted of defrauding its own customers, so we know we need to keep a very close eye on them.

When you look at the largest banks in the country, however, you quickly realize that the increase of the oversight threshold from $50 billion to $250 billion will exempt a lot of them.

The 10th largest bank in the country is State Street Bank and Trust Company, located in Boston. It has $235 billion in assets, meaning it’ll no longer be overseen and scrutinized as it was.

In fact, just 9 banks will continue to be overseen. A whopping 30 banks that’d previously been overseen will no longer be watched.

Is this the right choice for our country, and our communities?

I don’t think so.

The banking cartel that’s going to buy upwards of $100,000 worth of ads for Tester does think so.

Starting in two days, their propaganda will begin hitting the airwaves, and I bet you’ll see their ads dozens of times.

This propaganda will wear you down, and soon you’ll begin to believe it.

I can’t help but think that Tester’s stance on the banks will not only hurt the country for today’s citizens, but for future citizens as well.

Montana’s past is full of examples of the banks ruining people’s lives.

Let’s hope Tester’s recent moves, and his newfound friends, don’t put us down that road again.