The big news came out on Wednesday evening. We were told the budgeting process hearings had started. The mayor assured us that taxes will go up.

He blames the city’s budgeting woes on the state. He complains the state won’t give him a resort tax.

The mayor thinks that if he could just tax tourists…all of his problems would be solved.

I don’t think so, and I’ll explain why using the mayor’s own budgeting documents.

Here’s what we know about the budgeting process timeline:

- June 29: Budget presented to city council

- August 1: DoR taxable values out

- August 3: City council deliberations on budget, MRA additions

- August 8: Public hearing on street district maintenance costs

- August 10: City council committee discussions on budget

- August 15: Public finally allowed to comment on budget

- August 17: City council goes back to committee to discuss

- August 22: Final public hearing and approval of budget

Today we’ll look at two of the main budgeting documents, the 3-page Overview of Budgeted Resources and the 1-page Budget Analysis.

Let’s start with that first one. This is what we learn:

The city’s general fund starts with $9.5 million

- There’s $85.7 million in revenue from taxes/assessments, non-tax, and transfers-in

- There’s $75.8 million in expenditures to transfers-out, budgeted expenditures, and savings

- This gives us a final general fund ending balance of $9.9 million

There’s also a 3-page document that details the changes to the baseline budgets, based on department requests for more or less money.

This is all about changes to the general fund and how that might affect the nearly $10 million we have in there now.

Here’s what we learn:

- $13,000 increase to the city council

- $17,000 increase to mayor’s office

- $32,000 more for central services

- $39,000 more for IT

- $47,000 more for the finance department

- $71,000 more for the city court

- $95,000 more to Human Resources

- $250,000 more for development services

- $423,000 more for the police

- $3,700 less to the city clerk

- $7,000 less for the city attorney

- $7,600 less for the cemetery

- $54,000 less for facility maintenance

- $106,000 less for vehicle fleet maintenance

- $561,000 less for the fire department

- $1.2 million less for housing

- $1.6 million less for engineering

- $3.2 million less for non-department

Analysis

The city is planning on spending $7.1 million less via the general fund for 2023.

I wonder about the reasoning behind this.

For instance, is spending $1.2 million less on housing next year the right strategy in a time when we’re suffering the worst housing shortage in a generation or more?

From what I can tell, the department hasn’t appropriated any money toward personnel costs at all. They were over a million dollars last year.

In that regard, I suppose the housing department isn’t really about building new housing…but ensuring all the low-income folks that we support with tax dollars can stay in their tax-funded homes.

Hopefully this topic will come up in the budgeting meetings.

Next are the special revenue funds. There are 31 of these that bring in even more money for Missoula’s coffers:

- The starting balance for special revenue funds is $18.6 million

- $62 million more is brought in through taxes and transfers

- $42 million is spent on budgeted items

- This gives us an ending special revenue fund balance of $19.6 million

Analysis

That’s a lot of special revenue for a city that claims it doesn’t have enough money, needs to raise taxes, and wants to put a sales tax in place.

Why isn’t this enough money…and how much would be enough?

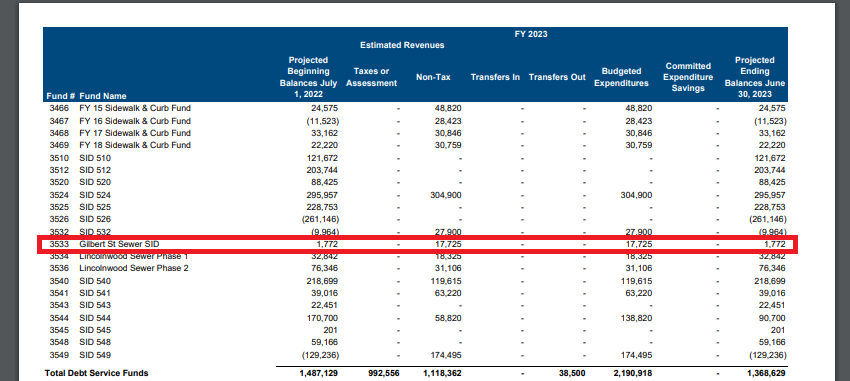

Next up is debt service funds. The city currently has 38 of these, with one going back all the way to 2002.

The starting debt balance is $1.4 million and the ending balance is $1.3 million

We spend just $2.2 million a year to service our debt. We could pay it off faster, but that would take money from pet projects. So instead we pay more interest long-term…like with the 20-year debt on the 2002 sidewalk and curb fund. The bankers are happy.

Analysis

These funds aren’t budgeted away, either. If they were, they couldn’t be used to move money around in the budget…which is their current purpose.

That’s why we have something like the Gilbert Street Sewer project. It has a beginning debt balance of just $1,772.

Now, you’d think we could just pay that off…but no.

Instead, we’ll use that debt fund to raise $17,725 in revenue…from somewhere…and then in turn use that $17,725…for something.

That leaves us with the exact same debt we started with, $1,772.

Every single debt service fund is the same. Just one of the 38 debt funds that sees its balance go down over the year.

In other words, Missoula has no intention of paying its debt off in full.

County Comparison

Missoula County is really screwing the pooch when it comes to long-term budgeting.

They currently spend around $10,000 a year on trail maintenance, but if their new pathways and trails plan goes through in its current form, that would balloon to $400,000 a year.

This at a time when both the city and the county are already in a logjam over losing their ARPA covid money from the feds, which is set to finally sunset, thank God!

Politicians in Missoula just can’t seem to turn the spigot off, however. I suspect the final cost of this won’t be $400,000 a year, but somewhere in between the current $10,000 and that number.

From this year forward, expect our trails budget to jump to $50,000 to $100,000 a year, at least.

Conclusion

We have a current balance in the city’s general fund of nearly $10 million and almost $20 million in special revenue funds.

So we have $30 million sitting in the bank right now to start the budgeting process with.

I doubt this will be mentioned, as doing so might make people think we don’t actually have to raise taxes.

But the mayor wants more money.

So he'll put out a lot of BS, and the local news outlets will eat it up...like they did this week.

No analysis will be done on the actual budget documents like we just did. If that were to happen, you'd realize we have $30 million sitting in the bank right now.

Why do we need more taxes?

Because the mayor can't control himself, that's why.

There is no indication that Missoula wants to fully pay off its debts, which would give it more annual revenue via savings from paying interest on that debt.

Currently, we have $1.4 million in debt from the service funds and we’ll spend $2.1 million on debt payments this year.

When the year is over, we’ll have $1.3 million in debt still.

So in effect, we will spend $700,000 to lower our debt by $100,000.

This makes no sense to me, but that’s how the mayor wants it. It’s like this every year, though some years are worse than others.

That means we waste hundreds of thousands of dollars needlessly.

I call this corruption. At the very least, it's incompetence.

I wish we’d just pay off the $1.4 million in full and be done with it, allowing us to rebudget what we currently spend on interest.

I doubt any of the 12 city council members will come up with this idea, however.

All in all, I expect business as usual, with the councilors in Engen’s pocket outvoting the new blood that thinks they can change things.

Missoula will raise taxes further, the city will slip deeper into debt, and the income gaps dividing our town will only increase.