I got a call from James Grunke at 9:30 this morning.

He wanted my email address so he could send me the Missoula Economic Partnership’s (MEP) financial reports.

You might remember that yesterday I got into the finances of this agency a bit.

You can find information about the MEP on their website, primarily in their FAQ.

For instance, we’re told that the MEP has an annual budget of $640,000.

That breaks down like so:

- $240,000 to attract new businesses

- $200,000 to support existing business growth

- $160,000 for innovation and small business support

- $40,000 for investor relations and communications

We know that 67% of the MEP’s funding comes from private donors – 80 businesses in all – with the other 33% coming from Missoula taxpayers.

Those private businesses have to pay $500 a year to remain a member.

The taxpayer portion comes from city and county taxes, as well as from UM and the airport.

We know this amounts to $100,000 a year.

So, let’s dig into that today.

The Missoula Economic Partnership’s Finances

What businesses are those exactly…bars and casinos and fast food joints?

Because that’s about all the City Council has approved lately when it comes to new businesses.

And how about the $200,000 they spend to encourage existing businesses to grow?

How’s that working?

Let’s dig into the numbers to find out.

First of all, the document that Grunke sent me is a complete joke.

Here it is:

I immediately sent an email to Grunke asking if he was serious.

The city budget is 372 pages and their Comprehensive Annual Financial Report is 337 pages.

You’re telling me this 1 page piddly-dink report is what the MEP goes off of?

Boy, that agency has a lot more problems than I realized!

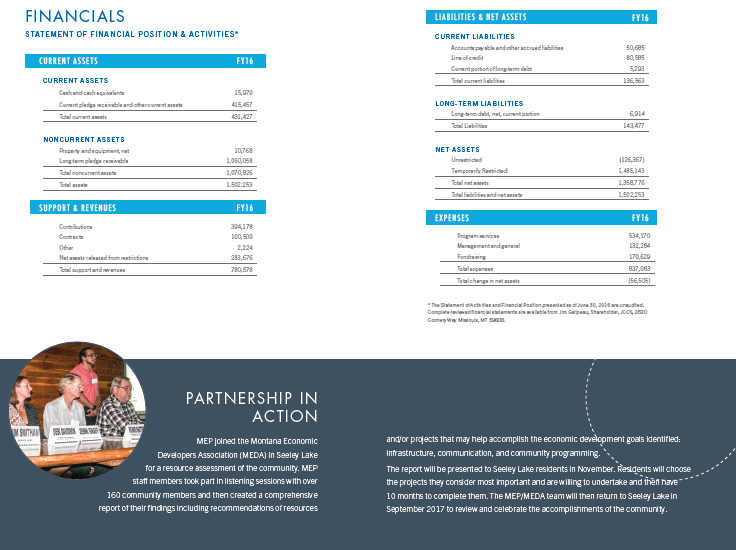

Anyways, the assets.

For 2016 the MEP had just $16,000 in cash.

They also had $415,000 in “current pledge receivable and other current assets,” something that spurred them to list total current assets at $431,000.

Talk about an imbalance between cash on hand and what they think is coming to them, huh?

The MEP also has $11,000 in property and equipment, with another $1.06 million in “long term pledge receivable.”

When the MEP lists these as-of-yet non-existent assets it comes to a figure of $1.5 million for total assets.

In actuality we know the MEP only has about $27,000 in hard assets, however.

No wonder they always need more of your tax money.

So where are they getting that money?

- Contributions: $394,000

- Contracts: $100,000

- Other: $2,000

- Net assets released from restrictions: $283,000

All of that comes to about $780,000 in revenue for 2016.

I wish I could get a little more detailed, but the MEP doesn't want you to know those details.

When we look at liabilities we find that the MEP has a line of credit of $80,000 and accounts payable of $50,000, as well as long-term debt of $11,000.

So total liabilities for the MEP are $143,000.

The MEP also has another $1.4 million in temporarily restricted assets, though I’m not sure what the catch is on these.

When you total up those net assets and liabilities you get $1.5 million.

Finally, expenses for the MEP in 2016:

- Program Services: $534,000

- Management and General: $132,000

- Fundraising: $170,000

That comes to $837,000 in expenses for last year.

I wish I could tell you more, but the MEP doesn’t want you to know what they spend money on or where that money comes from.

That alone should raise a red flag with you.

The Shady Missoula Redevelopment Agency

- Fiscal Sustainability

- Harmonious Natural and Built Environment

- Quality of Life for all People in All Places

I feel that the MRA is failing in their third goal.

I say that because the agency continues to request money for building projects, which in turn drives up our taxes.

That in turn means I have less money in my own pocket, thus lowering my quality of life.

You’ll find all this information in their financial statements.

When we dig into the 372-page Missoula budget for 2017 we find that the MRA has the following budgeted items:

- URD III: $16 million

- URD II: $2.4 million

- Tax Increment Debt Service Clearing: $2.1 million

- Tax Increment Bond Clearing: $1.7 million

- Tax Increment Debt Service: $1.05 million

- Tax Increment Bond Reserve: $675,000

- Front Street URD: $630,000

- Front Street URD Tax Increment: $616,000

- Front Street Parking Tax Increment: $421,000

- Front Street Sub Lien Tax Increment: $217,000

- Safeway URD II: $190,000

- Revolving Lane URD: $190,000

- URD II Intermountain Bond: $153,000

- Scott Street Cleanup: $60,000

- Riverfront Triangle Urban Renewal District (URD): $37,000

- North Reserve/Scott Street: $28,000

Those 16 items come out to $26.4 million.

So what is that money used for?

It’s hard to say – nearly all of the line-item expenses are simply listed as “miscellaneous.”

Still, when we dig into URD I and II we find that $6.4 million has been spent to build “over 13 miles of sidewalks” as well as “curbs, street trees and repaved streets.”

$6.4 million for that.

Am I the only one scratching my head here?

Let’s take a moment to look at sidewalk costs in Missoula.

The Burdensome Cost of Missoula Sidewalks

I’m talking local jobs.

And yet 70% of Missoula’s sidewalk work is done by out-of-town companies.

WTF?!?

If you want to build the 360 miles of sidewalks that the city currently says it needs, it’ll cost $28 million.

Throw in the curbs and other features and you’re looking at $168 million.

Why the huge jump there?

I have no idea.

If a Missoula homeowner wants to get a new sidewalk outside their house, it could cost $10,000 to $15,000….according to the Missoula city government website.

That’s a lot of money, even if the homeowner is paying $100 a month.

I wonder if the city is getting the best deal here.

We know that concrete in Missoula costs $6 per square foot.

So if we do the math, Missoulians should be getting a 1,667-foot sidewalk for $15,000.

That’s way too expensive, and way too much sidewalk.

Many sidewalks are 800 square feet.

So by that calculation, a Missoula sidewalk should only be costing $4,800.

Well…why is Missoula charging $5,200 to $10,200 more than the job requires?

- In Atlanta, for instance, an 800 square foot sidewalk costs $4,185.

- In New York City it costs $5,922

- In LA it costs $3,729

So what the hell is going on in Missoula…and what is that Missoula Redevelopment Agency doing?

Remember, they spent $6.4 million for 13 miles of sidewalks, some curbs and some trees.

Smells funny to me.

Back in September 2012, the city decided to help homeowners out a bit.

The city had 394 miles of sidewalks at that time, though many neighborhoods were redoing sidewalks while other neighborhoods never had any to begin with.

In fact, 360 miles of sidewalks are needed in the city.

The program the city came up with would pay the first $1,000 of a new sidewalk, and any additional costs up to $7,000 would be split evenly between the homeowner and the city.

Anything above $7,000 and up to $15,000, the city would pay after that.

The city also said back then that the average cost of a new sidewalk was $3,500…even though one of the City Council members said his sidewalk had cost $13,000.

“He threatened in jest to build a toll booth on his sidewalk and charge the people who use it.”

Other ‘Fun’ Missoula Budget Items

That’s about what it’s come to in Missoula, what with our terrible tax situation and a city that doesn’t care.

Anways, I just want to quickly mention a few things that caught my eye in the 2017 Missoula Budget.

- $2.1 million for the annual sidewalk installation/replacement program

- $588,000 for a wastewater treatment plant admin building

- $345,000 for VanBuren Street reconstruction

- $335,000 for gravel street paving

- $326,000 for a wastewater treatment plant lab expansion

- $263,000 for police restrooms at City Hall

- $151,000 for the Fort Missoula Regional Park

- $150,000 for City Hall sidewalk improvements

- $125,000 for curbs and sidewalks on South 1st Street

- $105,000 for police parking lot lighting

- $97,000 for recreation software

- $60,000 for a City Hall growth plan

- $60,000 for downtown signal upgrades

- $41,500 for boat ramp construction

- $30,000 for police locker rooms

- $25,000 for a basketball court in Pleasant View

- $23,000 for fire hydrants

Those 17 items come out to $4.8 million.

Now let’s get into the cars and trucks:

- $45,000 for a 2007 Ford F350 for the Street Division

- $35,000 for a 2007 Chevy Impala for the Fire Chief

- $35,000 for a 2010 Ford Fusion Hybrid for Plant Maintenance

- $35,000 for a 2006 Chevy Silverado Hybrid for the Parks Department

- $30,000 for a 2012 Ford Escape for the Building Division

- $30,000 for a 2005 Chevy Colorado for the Building Division

- $30,000 for a 2005 Dodge Caravan for the Traffic Division

Those 7 vehicles I listed come to $240,000.

Yep, a quarter of a million so Missoula city workers can ride around in style.

And don't think for one minute that that's it - there are 6 pages of vehicle expenditures in all.

Folks, one of my odd jobs is to go around to 7 used car lots here in Missoula once a month to inventory used vehicles.

I know what used vehicles cost, and my, the city is getting ripped-off big time!

What’s especially sad is that many of the vehicles the city buys aren’t even bought in the city.

I’m sure some of those things I’ve listed off are needed.

But…do we need all of them, and why do they cost so much?

I mean, $45,000 for a 10-year-old truck?

A quarter of a million dollars so the police can have their own bathroom?

Hey, that’s great – I’m sure they need that so they don’t have to get out of their uniforms all the time.

I’m sure the Street Division needs to ride around in a 10-year-old vehicle and not a 20-year-old one.

But do you want to go to some senior citizen on a fixed income and tell them they have to move out of their home so the police can piss a little easier, or people can drive around in style?

I don’t.

I don’t want to do that at all.

And yet that’s the story in Missoula when taxes go up 95% over 12 years.

Old people have to move, sometimes from the homes they’ve had for 50 years and which they've raised their kids in.

All because the City of Missoula has run amok.

Think about that.

And think about who you want challenging these budget items on the City Council.

I'm running this year and I could use your support.