I’m not sure about that, but today let’s discuss some things that lack reason, logic and common sense.

Yes, it’s time to talk about money on this site…again.

Watch Her Soar!

It has lots of stuff you just won’t hear the corporate media talking about.

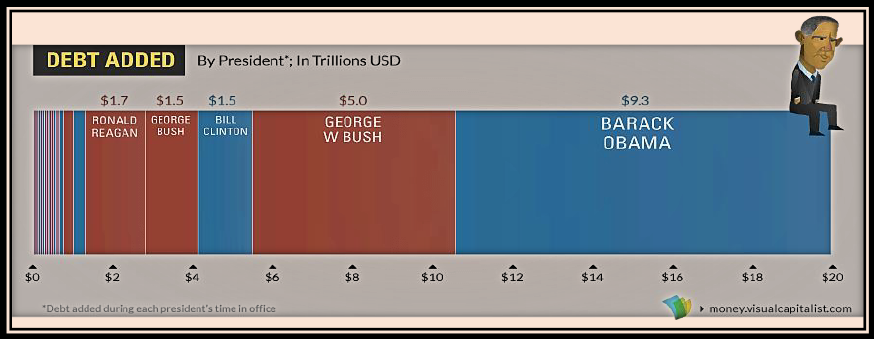

For instance, take our terrible national debt situation, which can be illustrated with this graphic:

Back in the Reagan days we had around $2 trillion in national debt.

Today we have nearly $20 trillion.

Compare that with other countries:

- Japan has $11 trillion

- Italy has $2.5 trillion

- China has $2 trillion

- Canada has $1.5 trillion

- Brazil has $1.3 trillion

- Spain has $1.3 trillion

- Australia has $601 billion

- Argentina has $287 billion

Now, it’s true that America has the highest gross domestic product rate in the world, at nearly $19 trillion.

The second closest country is China, with nearly $12 trillion in gross domestic product.

Our public debt to GDP ratio is terrible, however, coming in at 76% compared to China’s 17%.

To me, that’s just not sustainable.

Wow, Montana…WTF?!?

- $48 billion in state and local GDP

- $5.5 billion in state and local debt

- 12% debt to GDP ratio

- 22,568 people unemployed

- 122,443 people on food stamps

You know how I feel about debt – it’s not good. I’m saddened to see that Montana has so much.

Missoula is a big source of it, I’m sorry to say.

Our 4 National Programs

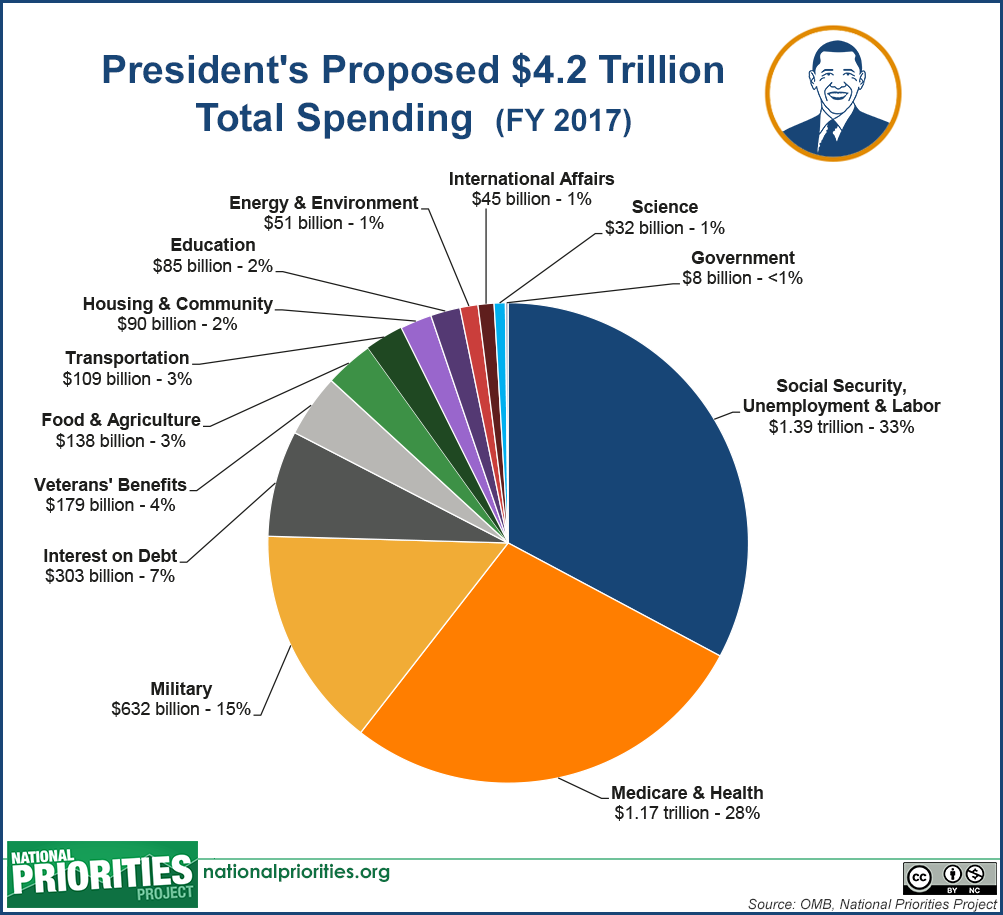

They’re deep in debt and they still spend like a drunken sailor.

Here’s how that breaks down for 2017:

Entitlements – those are ‘the killers.’

- 61% of our federal budget goes to Medicare, Social Security, and Unemployment.

- 15% goes to our bloated military.

- 4% goes to the veterans that our bloated military created

- 7% goes to pay interest on our massive national debt.

That’s 87% of federal spending right there, just for those four areas.

Yes, our four national programs. Nothing else really amounts to much by comparison.

Don’t Worry, Be Confident!

But…if we have so much debt, and federal spending is so out-of-whack…then why is consumer confidence continually so high?

Also, why is the stock market going up and up and then up some more?

And what the hell’s with interest rates?

- First, if consumer confidence was so high, then why has consumer spending fallen off?

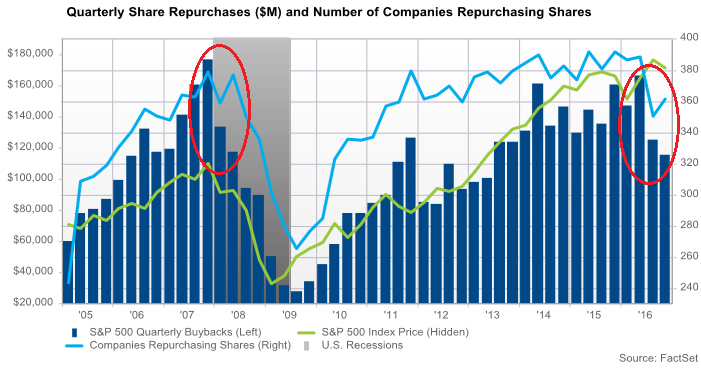

- Next, would the stock market keep going up if companies weren’t buying up their own stock?

- Finally, the Fed has bumped interest rates to 1%, the highest rate since 2008.

That doesn’t really mean much for you, though. Put your money in a CD and it’s only earning 0.33%.

So even if you want to save, the Fed won’t let you. What they will do, however, is increase the national mortgage rate average to 4.5%.

On top of that home prices are supposed to go up by 4.6% this year, even though the average worker only got 2.8% more in wages from 2016 to 2017.

In regard to the stock buybacks, we haven’t seen it this bad since just before the 2008 meltdown.

For common workers and households, things are as terrible and hopeless as ever.

The January quit rate was 2.2%, meaning just 3.2 million people felt confident enough to quit their job and look for a new one.

Remember, around 125 million people in this country are working.

You won’t hear any of that quit rate talk in the corporate media, just more propaganda.

For instance, yesterday it was reported that consumer confidence in the economy is at a 13-year high.

That’s funny, because two weeks earlier we were told that consumer spending has slowed.

It went up by a meager 0.2% (a ‘’good’ month would be like December, when it went up 0.5%).

The reason for this decline?

Car sales slowed and utility use fell. On top of it “inflation recorded its biggest monthly increase in four years.”

Yes, let’s not forget that the personal consumption expenditures price index went up by 0.3% in January.

Personal income doesn’t match that, as it rose just 0.4%. Disposable income actually fell by 0.2% during that time as well.

13-year-high my ass.

That Dastardly Fed!

Hence the interest rate hike this week – gotta slow down that overheating economy, one that’s been injected with too much printed money from the Fed printing presses.

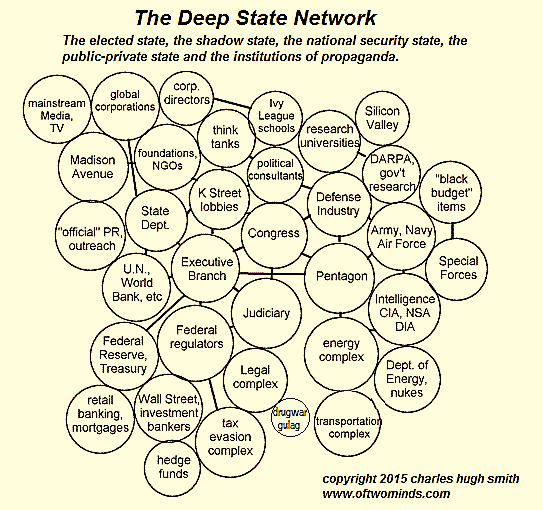

Have you ever heard the term, ‘playing both sides’?

I can’t help but think that’s what the foreign-owned and never-audited Federal Reserve is doing.

Please, if you haven’t done so, read my detailed history of the Fed.

It’s the most popular article on this site month after month, for a variety of reasons.

The Deep State Gains Credence

This was done to create the illusion of an economic recovery, which allowed the stock market to soar wildly, enriching plenty of the 1%.

This “recovery” was fueled by massive increases in government spending, all of which came in trillions of bank notes printed by the Fed from nothing.

This was phony, deficit-creating, zero-interest funny money.

The Fed wanted another 8 years of that shit but they couldn’t quite get Hillary over the finish line.

Damn that Trump and his draining-the-swamp ways!

So the Fed will collapse the economy, destroying every private pension fund as well as the net worth of most working Americans.

I have no doubt that this will happen, and who better to blame it on than Trump?

The deep state establishment will not give up its power, it’s as simple as that.

Conclusion

- Who’s telling you what to do with your money?

- Who’s telling you what to think, or what’s ‘going on’ in the world?

- Where are you getting your information?

What you’re not being told is just as important as what you are being told.

- Why aren’t you being told it?

- Why are some things hard to find and not discussed much, like all the info I’ve given you in this post?

Think about that, as well as the various agendas at work and how they feel about you.

Are you important, and if so, why?

And if you’re not…then what?

I hope you think about these things, as well as your place in the world.

You don’t need a lot of money or a fancy job or vast connections to have power and influence.

Make it happen.

We need more reason, logic and common sense. We need the people that can bring it.

The people running things from behind the curtain sure don’t have any.