Missoula

Missoula

The project is a parking garage downtown.

Why, I ask, are we using taxpayer money so a private company can finished a project?

Isn’t that what the banks are for?

They do make loans, right?

Maybe that’s the problem – it’s a loan, and that means you have to pay interest on it.

It costs more than just getting the money for free, which, if you’re a private developer, is really good for your bottom line and thus your goal of getting the fanciest house in the hills, the best damn car you can find, and perhaps even that trophy wife.

I can’t help but think that’s what the good people at Front Street Partners and the Farran Group are thinking when they hold out their hand to the City of Missoula and ask for more.

Oh, look at them there, those assholes that want you to give them your hard-earned money for free.

The gall, the sheer gall.

I have to hand it to the slimeballs, however – they are smart.

I mean, why work hard when you can just get things for free off the back of the American middle class (or what's left of it)?

That’s what those 5 men do, that’s how they make their living.

Assholes like that prey upon the incompetence of our local government.

I say incompetence because the City of Missoula is currently $88 million in debt.

And that when the city only took in $105 million in revenue in 2015.

Sounds like a lot but the city spent $116 million in 2015, meaning we have a budget deficit of $11 million.

Well, just tack it onto the debt!

That’s the terrible mindset we’ve been under here in Missoula for years, decades even.

Let’s take some time to explore that today.

You can find a good look at Missoula’s debt problems in a 14-page PDF file called “City of Missoula Debt Management.”

The 389-page City of Missoula 2015 Budget is another fine area for numbers and charts and such.

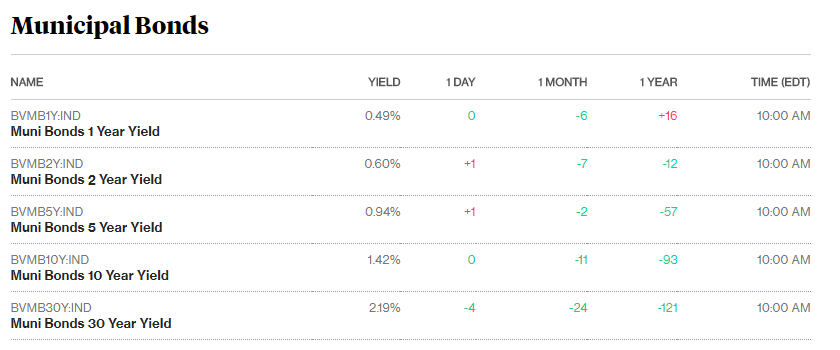

What worries me a lot is the bond market.

Currently it’s costing you more money to buy a bond then you get back when it matures.

Take the fixed interest rate for bonds, which if you were to buy one today is 0.10%.

That means if I buy a $1,000 bond for my kids college education at $1,000 I’ll be earning $1 in interest a year.

If it’s a 20-year bond I’ll make $20.

It didn’t always use to be like that. Back in 1998 the fixed interest rate was 3.4%, meaning I’d earn $34 a year for that bond, or $680 in 20 years.

That’s how people could save up for 20 years and retire, maybe head down to Florida. Those days are long gone.

And hey, let’s not complain too much. In November 2010 the interest rate was 0% and it stayed that way until November 2013, rose for a year, then fell back to 0% for most of 2015.

It just doesn’t make sense to buy bonds, especially when you get into negative interest rate territory, where you actually pay for the privilege to lose money.

Currently municipal bonds are doing a little better than the average fixed rate bonds, as you can see:

So in this case, for a 30-year bond we’re getting an interest rate of 2.19% and nearly 1% if we go just 5 years, which let’s face it, no one in city government ever does.

Most of the bonds that have been issued in Missoula are 20-year bonds, and the 2004 Aquatics Park bond is a fine example.

It was 20-year at 4.2% but then it had to be refunded in 2012 (a new bond issued to make up the losses) and that came in at 1.5%.

The City Hall Expansion Bonds, which also included funds for fire station construction (1988 and 1992 elections), were issued in 1993 and 1994 at an interest rate I don’t know, but were refunded in 2004 to reduce the interest costs of those earlier bonds.

Remember, by 2004 those bonds were halfway to maturity. Now we refinanced them at 3.5%

The 2006 Fire Station Go Bond is another example. We did that for an unspecified amount of time at 4.4%, with the ‘promise’ that the tax levy will be discontinued when the bond is repaid.

That fire station bond, however, was refinanced in 2013, though it is expected to mature this year. Let’s hope they don’t refund it to milk it more.

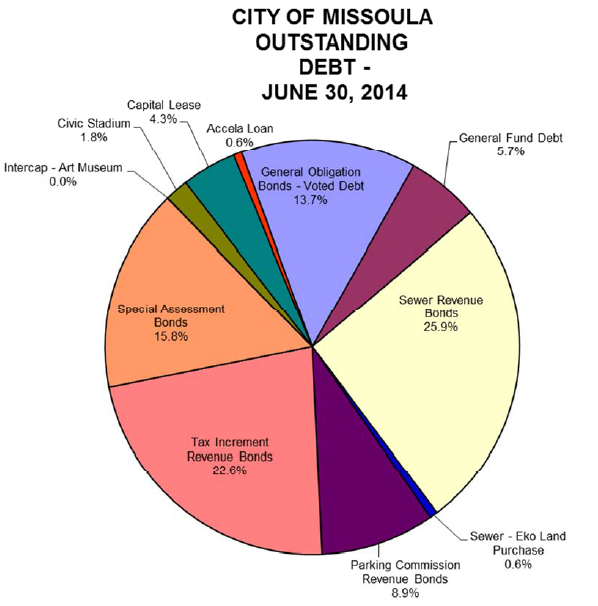

I say that because the City of Missoula is heavily in debt, as you can see:

So that’s a bit old, two years in fact.

At the end of June 2014 the City of Missoula had $88 million in long-term debt and $78 million of that was bonded debt.

- Just $11 million of that debt is backed by the full faith and credit of the government.

- We know that nearly $13 million of that debt is special assessment debt, meaning if property owners default on their obligations, the city is libel and has to pay that off.

So how would property owners default? Simple – they can’t pay the taxes on their homes and lose their home.

The ways the laws are set up, Missoula can continue to take out debt based on its assessed valuation, meaning Missoula can take out $110 million in total.

Yes, we have just $22 million more in debt that the city will force upon us…at which point I expect they’ll try to raise the city’s assess valuation so they can take out more.

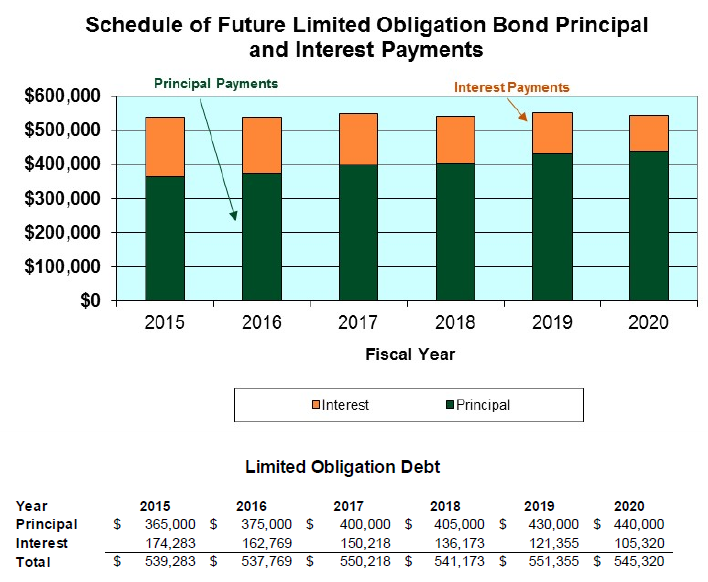

We know that because of the limited obligation debt that Missoula has, it’ll be paying out $850,000 in interest alone on the $2.4 million in additional debt it wants to take out.

Yeah, you heard right…35% of that $2.4 million loan will be eaten up by our future interest payments.

What are we doing?

The City of Missoula touts its AA+ bond rating from Standard & Poor, which was handed down in May 2014.

Yes, isn’t it spectacular that we can borrow so much?

That’s the argument, and they tell us that because our interest rates are so low.

Yep, so low that 35% of our loans are eaten up by those interest payments, and as in the case of the Aquatics Center, this often means we have to reissue the bond to make up the difference.

More debt to pay off the debt we already have.

My God, we have serious problems. If it was a household taking out a new credit card with a 21% interest rate to pay off one with a 9% interest rate, we’d say they have problems.

But because a government is not like a household, we not only do that, we encourage it again and again.

Who the hell came up with this silly thinking?

Oh, that’s right…those kooks at the Fed.

What’s especially sad is how far we fell in just 5 years. In June 2009 the City of Missoula’s debt was just $61 million but by 2014 it’d risen to $88 million.

We’re going in the wrong direction here, folks.

At that time, however, Missoula had just a AA- rating from Standard & Poor.

Think how much better our lives have become by turning that ‘-‘ into a ‘+’, just think about it.

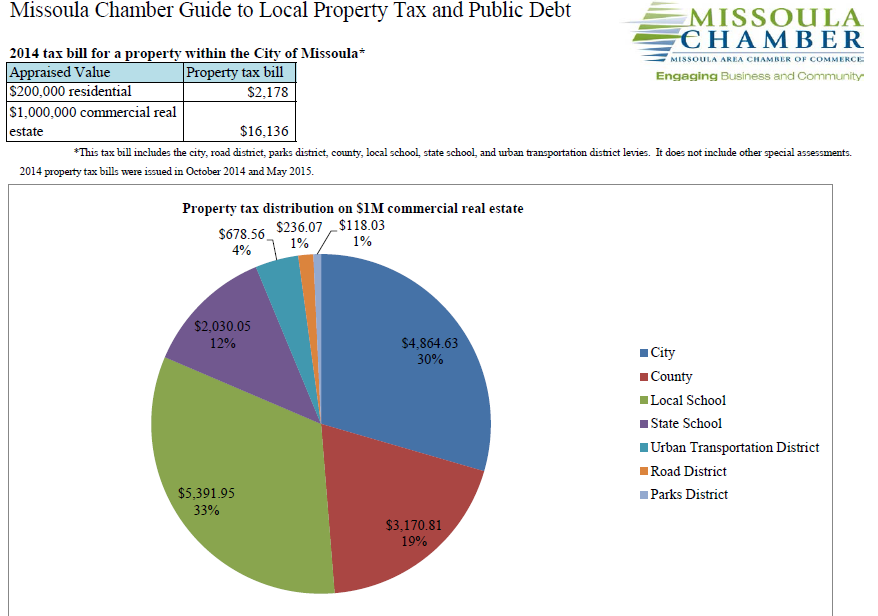

Here’s what you’re paying for the taxes on your house in Missoula:

So if you have a house worth $200,000 you have to pay $2,178 a year in taxes, or about $182 a month.

We know that the following bonds increased Missoula property taxes like so on that $200,000 house:

- MCPS Operation Levy: $4.45 (district only)

- Rural Fire District Levy: $26.29 (county only)

- 2016 City Tax Increase: $37.33 (city only)

- 2015 County Levy: $23.67 (county only)

- Parks and Trails Bond: $37

- 2015 Elementary Bond: About $140

- 2016 Library Bond: ?

- Open Space Bonds: ?

Sometimes we don’t even know what the cost will be, as with those last two.

Oh my, oh my.

We have serious problems here in Missoula. Instead of addressing them, however, I feel we’ll just hand that $4 million of your tax money off to those rich developers.

Here, let’s take a look at them once more, their smiles, their lies.