Why don’t we put down the partisan attack rods for a bit and dig into that, eh?

You sure as hell know that no one else in this state will.

This Week’s Disastrous Vertical Merger

Let’s discuss vertical mergers, or companies in one business joining together to take a larger share of that business.

This often means less competition among businesses, higher prices, and less choice for consumers.

For companies, it means a greater ability to grab your eyes for their content. Taking it further, this means they can show you more targeted ads, something that also allows them to use the personal data they’ve been able to collect about you.

It’s all about profits under the guise of entertainment.

Please remember…for every 30 minute TV show on the air right now, you get 12 minutes of ads. Yep, just 18 minutes of content.

Now, what we’re getting at is the big vertical merger this week with AT&T and Time Waner. We’ll see more media companies – like Comcast, Fox, and Disney jump on the bandwagon in the coming weeks, possibly even today.

The AT&T-Time Warner deal was worth $85 billion.

With a number like that, you know this is a deal for the elites of the country, the rich and entitled…the people that tell us what to do.

They also tell us what to think, what to buy, and what’s good and what’s bad.

This is TV and internet and content…all provided by a large, global corporation that prizes its share price above all else.

To them, you’re just a meaningless consumer, one that pays the monthly bill for your smorgasbord of propaganda.

And my do we eat it up!

The DOJ did not, and they sued to stop this deal, something that resulted in a 6-week trial. They said that “the proposed merger would result in fewer innovative offerings and higher bills for American families.”

The DOJ claimed that AT&T would increase customer bills by 45 cents a month, which would net the company an extra $463 million a year.

Also, please remember that the CEO of AT&T made nearly $29 million last year. The CEO of Time Warner made $49 million.

They really need that extra 45 cents from you, don't they?

Alas, the judge in the case ruled in the corporation’s favor, against the public interest.

In fact, the judge said the idea that “the combination would limit consumer choice and stifle competition” was “poppycock.”

Now nothing stands in the way of several huge media companies joining together by June 20. These include:

- HBO

- Cinemax

- CNN

- TBS

- TNT

- Warner Bros.

- DC Comics

- Cartoon Network

- 10% of Hulu

- DirecTV

- Cricket wireless

CNN – a company being bought-out in the deal – tells us that this deal includes “AT&T’s enormous distribution system, including cell phone and satellite networks.”

The main basis for this deal was that AT&T felt it might go out of business if it didn’t join forces with Time Warner in order to “compete against giants like Netflix and Amazon.”

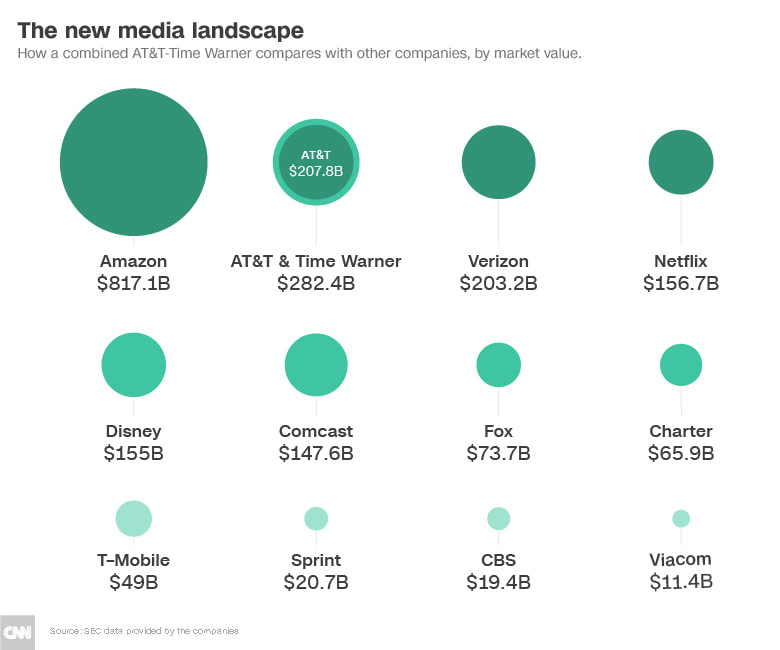

And that might be true. Take a look at what these companies are valued at:

As you can see, Amazon is the elephant in the room…earning more than twice as much as its nearest competitor – the newly-merged company – and three times as much as the next guy, Verizon.

So it makes sense for the companies to do this…they profit. The CEOs get larger golden parachutes, get to live in bigger gated communities, and their kids can go to posher prep schools.

Meanwhile, on the consumer and artist end we know that:

- There will be fewer channels for artists to get their work out on

- News distribution will now be put into fewer – and more self-interested – hands

- Innovation will be stunted as there’s a larger barrier to competition

Remember, during the 2016 campaign, both Hillary and Trump opposed this merger.

Another terrible aspect of this deal is that it paves the way for other vertical mergers, and ensures that any DOJ resistance will be futile.

Expect to see Aetna and CVS join up, as well as Cigna and Express Scripts. This will certainly drive premium prices up for heath insurance, and probably prices for prescription drugs too.

All of this will be sold to the public under the illusion that it’ll do the exact opposite – lower prices.

Perhaps in the short-term, but you and I both know those CEOs won’t be able to move into the larger gated community and send their kids to the very best East Coast prep schools, if they don’t start increasing those profits, which means an increase in consumer prices.

A Non-Neutral Internet

Net neutrality laws were shot down this week.

Just days before the AT&T merger, our 3-year-old net neutrality laws ended, having been shot down six months earlier by the FCC.

What this means is that the internet will change a lot, with distributors like AT&T no longer bound to supply you with the content that the content providers like Google and Facebook provide.

So in this case, AT&T might look favorably on sharing online content for companies they own – like HBO and TNT – but they might slow down the content coming from Facebook or Netflix, companies they don’t own.

We all know that slow content means you hit the ‘back’ button and go somewhere else. That in turn means lost business and lost revenue for the affected companies, something that will in turn drive up prices in order to recoup that lost revenue.

Either way – slow content or higher prices – consumers lose.

One bright spot is that service providers will be “required to publicly disclose any instance of blocking, throttling or paid prioritization” in terms of slowing down our content delivery.

That’s nice, but I doubt many will be looking for such instances. I expect so much content will be slowed down that there’ll be too many instances to list!

Another bright spot is that 20 states are suing to reinstate net neutrality.

Alas, I don’t think anything will change soon. Corporations are more important than consumers, and profits come before people.

This is your country, and you want it this way.