Missoula

Missoula

Oh…didn’t hear?

I’m not surprised – the Missoulian put the article up late last night and took it down early today.

They didn't even bother to share it on Facebook, yet another sign of their friendly, biased reporting toward Mayor Engen.

Why spread bad news, right?

Wrong.

The Missoulian article is called Tax increase of 3.87 percent expected in first draft of city budget.

In this article we learn that this 3.87% increase is just the base increase “before any city council additions” come.

That could of course drive the 2018 tax increase up to 5% or higher.

I decided to take a look at what the Missoulian would not.

You can see the City Council’s “tickled item” list on the city government’s FY 18 Preliminary Budget page.

Currently we see that just one city councilor is requesting an item, and that’s Julie Armstrong of Ward 5.

She wants $4.2 million for a Garden City Compost Facility Upgrade.

This is for the $3 million EKO Compost business that we bought last year.

So that place is already set to cost taxpayers over $7 million…and that at a time when we know they’re eliminating the bagging portion of its business, which accounts for up to 60% of the revenues.

What a mess.

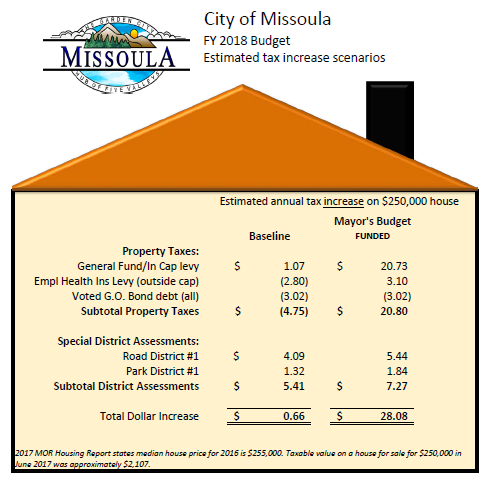

Currently the 3.87% increase with add just over $28 to the property tax bill of homeowners that have a $250,000 home…which is the average price on the current market.

Here’s what that looks like:

The main reason that we’ve had tax increases every year since 2009 is because “the city simply isn’t growing enough to collect enough taxes to cover its basic services.”

Basic services, eh?

Yeah, anyone that drives on our pothole-infested streets knows this quite well.

So besides a financial meltdown that happened nearly 10 years ago, what’s to blame for these tax increase?

A big one is city employee health insurance, which is going up by 13% next year, which comprises 0.5% of the 3.87% property tax increase.

And that’s about all we get from the scanty Missoulian article…an explanation of just 0.5% of next year’s tax increase.

Let’s dig a little further into this, shall we?

If you look at the 1-page City of Missoula Budget Analysis General Fund document you learn that:

- Missoula has $60 million in total revenue

- $25 million of that comes from property taxes, or 42%

- $23 million comes from non-tax revenues, or 38%

- $6 million comes from transfers in, or 10%

- $2 million comes from other taxes, or 3%

I have no idea where the other 7% of revenue is coming from.

We also learn that Missoula has:

- Negative $56 million in net expenditures

- A $237,000 net loss in income

- A $3.5 million beginning fund balance

- A $3.3 million ending fund balance

- A $611,000 target fund balance deficit

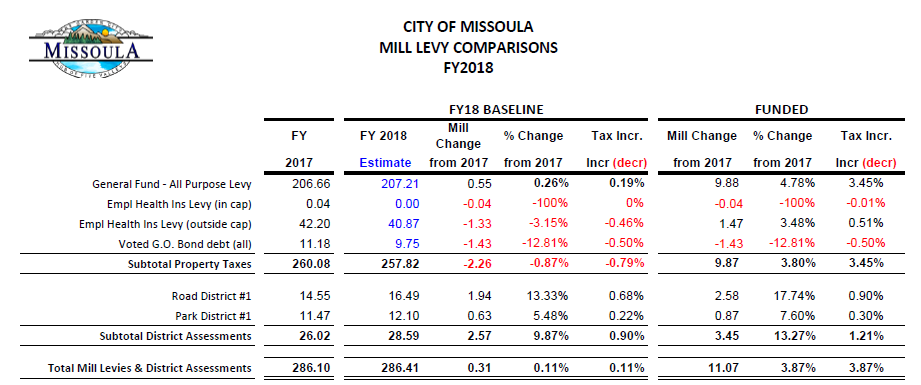

Here’s what the mill levy picture looks like as well, for those that are interested:

In the Mayor’s Strategic Budget Letter we learn what areas the 3.87% tax is going toward:

- 3.45% general fund tax increase

- 0.90% road district levy increase

- 0.51% employee health insurance levy increase

- 0.50% general obligation bond debt increase

- 0.30% park district levy increase

When we look at that larger picture we get an overall 2018 tax increase of 5.66%.

Um…am I missing something here?

Yeah, a lot.

In that letter the mayor goes on to say that we won’t even know until August what the certified tax values are.

“If revenues increase significantly,” he tells us, “we’ll bring further recommendations to council for consideration.”

And then he drops the real bombshell:

“In all, our new requests requiring tax revenues, all of which have merit, totaled $6,140,138, which would require a tax increase of 18.48%.”

Wow!

The city wanted to increase taxes by 18%, but held off on a lot of the “wait list” and ‘want list’ items…for now.

Conclusion

We know what just 0.5% of the increase is needed for.

On the other 3.37% we’re left in the dark.

And what the hell’s with this 18% talk that the mayor is hinting at, should revenues come in all pretty in August?

I just don’t know.

I’ll do more digging and keep you informed.

Public comment is also set to start on this new budget, though I doubt there’ll be much.

So for now, just be aware of what’s going on.

I don’t think things will be getting better for Missoula taxpayers anytime soon.