Yep, $14 million from the feds...all of which seems like it will be written into the base budget, meaning it’s permanent, meaning the city has to find a matching revenue source for that spending in subsequent years.

Um...where is that going to come from? The city doesn’t have a printing press like the U.S. Treasury does via the Fed.

I doubt we’d ever even consider using any money to pay down debt. How much are we paying on the $190 million principal now?

This is a great question, for it’ll tell us how many years it’ll take to actually pay the the debt off in full.

Let’s dig into this difficult question today.

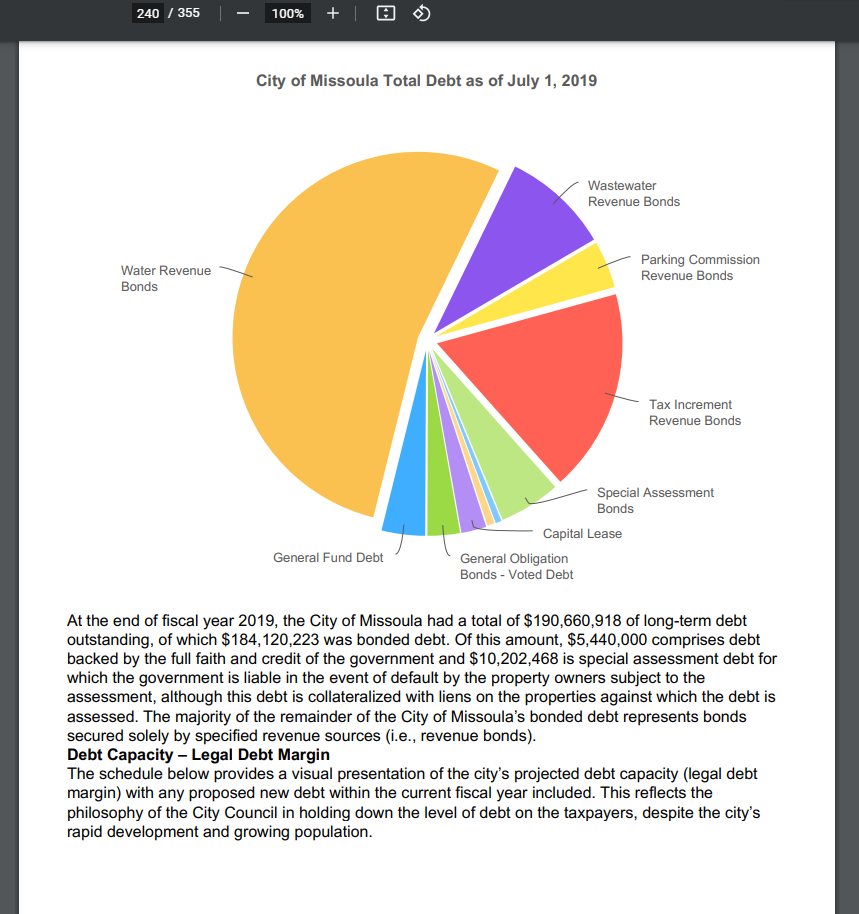

Let’s start off with the city’s $190 million in debt, which we established earlier this week by diving into the 2020 budget.

Now, I got the following information from the very short 2021 budget, which is just 71 pages. I got more from the 355-page 2020 budget.

According to the 2021 budget, just $554,000 a year is used to pay off the interest of our general fund debt. I’m sorry, but I can’t find out the total amount of general fund debt anywhere, nor what we pay on the principal.

But this isn’t quite accurate anyway, as we still have 11 other sources of city debt, mostly bonding debt.

Here’s some bonding debt from the 2021 budget with the amount we pay on the principal each year:

- Aquatics: $540,000

- General obligation: $365,000

- Capital debt: $1.7 million

- Enterprise fund: $48,000

- Wastewater: $1.3 million

- Stormwater: $5,000

- Parking Commission: $280,000

- Front Street URD: $304,000

- Scott Street URD: $73,000

- Riverfront URD: $38,000

- URD II: $625,000

All of that comes to $5.3 million in principal payments each year, plus another $2.3 million in interest payments. Let’s add in the general fund debt payments as well.

That means the city pays $5.3 million a year in principal and $2.8 million a year in interest on a debt of $190 million.

At that rate, it’d take us 35 years to pay that off, making Missoula debt free by the year 2056.

Ah, but not so fast!

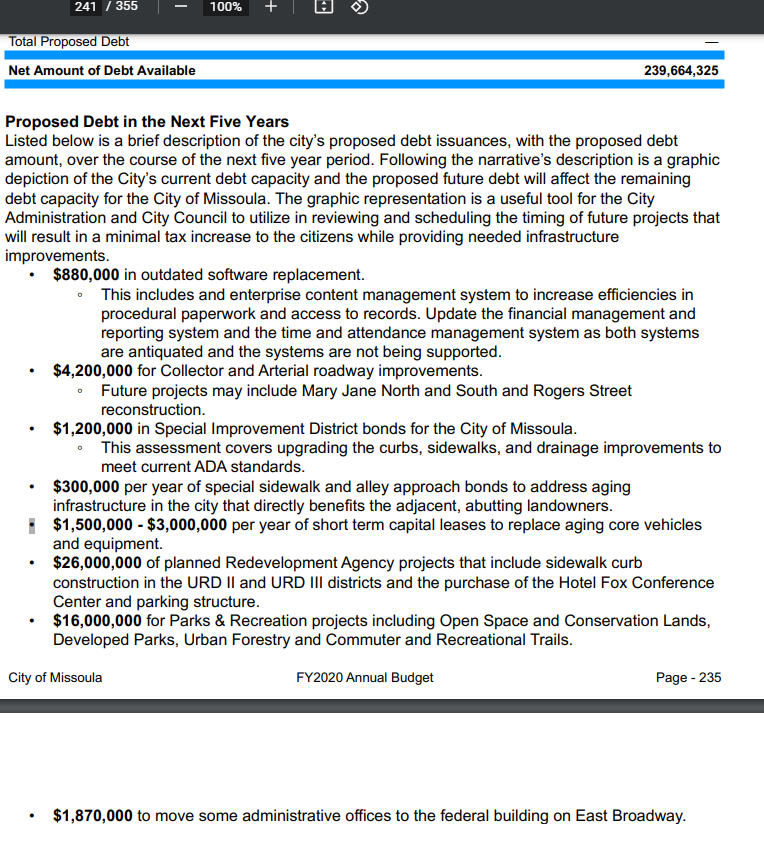

All that’s assuming we won’t take on anymore debt...but that’s a terrible assumption to make. The city itself says we’ll take on the following debt over the next five years:

- $26 million to purchase the Fox Hotel Conference Center and parking structure

- $16 million for Parks & Rec

- $4.2 million for roadway improvements, mainly Mary Jane North and South

- $3 million a year to replace aging vehicles

- $1.8 million to help move offices to federal building

- $1.2 million for sidewalk bonds

- $880,000 to replace outdated software

- $300,000 a year for special sidewalk and alley bonds

That comes out to $66.5 million of new spending over the next 5 years, or $13.3 million a year...not counting whatever the various departments want each year on top of it.

The real scary part is that the city openly admits that they can take on another $239 million in debt and they’ll be ‘just fine.’

Another $66 million over 5 years...and potentially another $239 million overall?!? My God...where are we going to get the money?

Simple - drive up housing prices and thus property tax income, force poor people out of the market to make way for more rich developments, rinse and repeat. It’s been happening for years, but has increased in speed over the past year.

All of that assumes the economy will keep on ‘humming’ like it is now, with low interest rates, a ‘booming’ stock market, and continual demand for housing.

Do you think all of those things will hold true? I don’t.

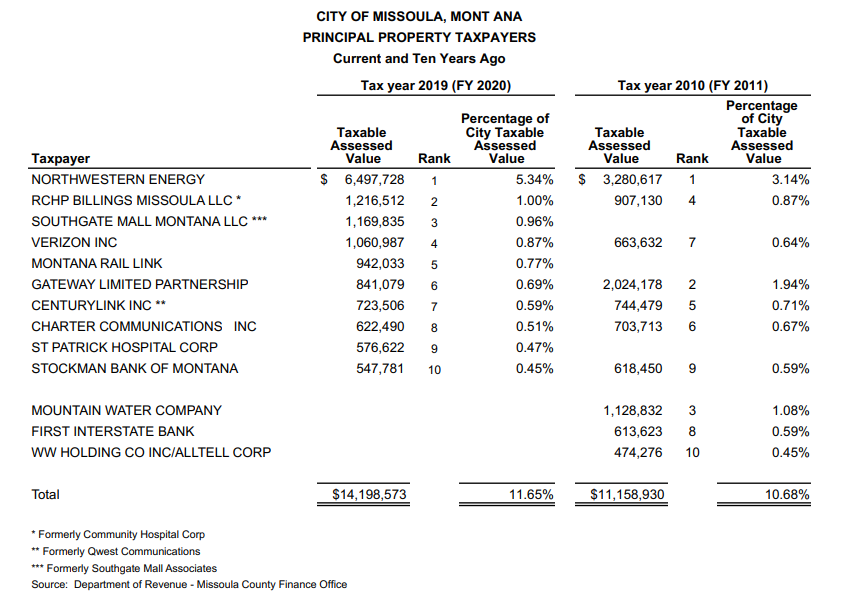

Finally, I’d like to take a brief moment to talk about the city’s largest taxpayers and how much revenue they generate for the city. Here’s an image from the budget that explains this:

Northwestern Energy is paying nearly double the taxes they did ten years ago.

Many other places are paying less. It’s interesting that ten years ago, we weren’t taxing the mall. The place seems to get one sweetheart-deal after another, don’t they? St. Pat’s had the same deal.

I’m not sure how valuable the mall will be going forward.

Over $2 million was taken off the tax rolls with the loss of Mountain Water, First Interstate Bank, and Alltell.

Despite that, the tax income from these large payers has gone up $4 million in the past decade, all because of increased taxes by the city.

With the monstrous amount of debt, and the insatiable desire to spend...you know full-well that Missoula will have to keep raising taxes while at the same time begging the state and feds for more bailout money.

This is a symptom of failed leadership.