Old school in Quinlan, Montana

Old school in Quinlan, Montana

It was called Getting schooled: Why the school choice bill asks the wrong question and it discussed the passage of SB 410, which allows for state funding of charter schools. Well, alright, it allows those sending their kids to charter schools to claim that as a tax write-off, to the tune of $150 a year.

Woo-hoo, honey – rally up the little ones and start up the beater, we’re puttin’ the kids in private school!

While I’m sure a few households in the state are saying something like that, I’m positive the overwhelming majority could care less, and will keep their kids in public schools. I’m tempted to say that’s where they belong, but I won’t. No, instead I’d like to talk about funding for schools, and how it’s looking mighty rocky, at least to these untrained economic eyes.

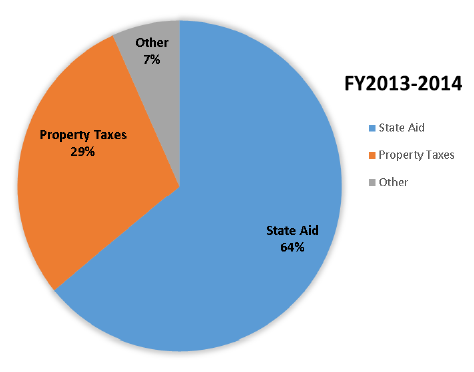

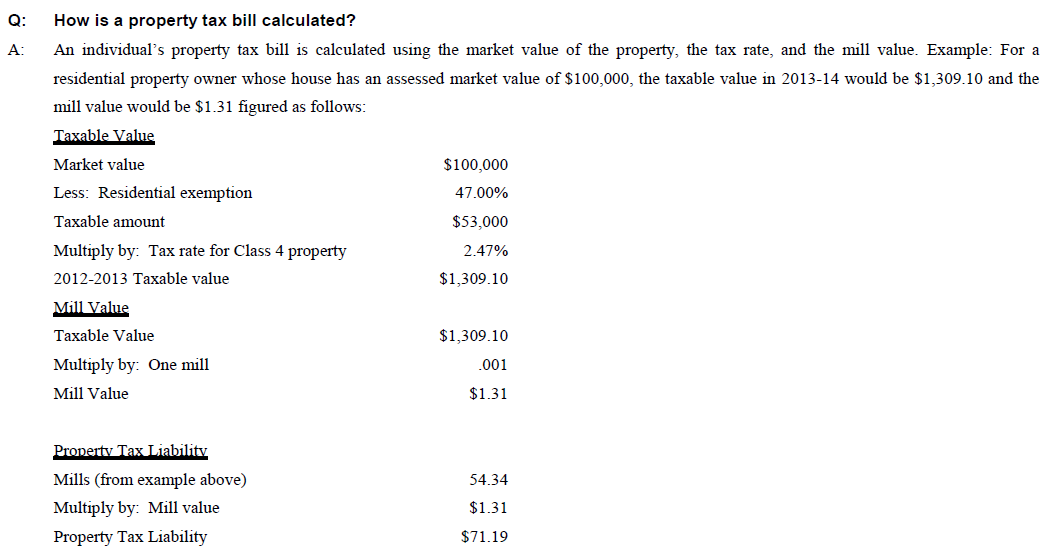

Really, though, when it comes to school funding, it’s more local taxes than anything. And when we’re talking local taxes, we’re talking property taxes, or what you pay on your home. This fall Missoula homeowners will be paying a lot more, $200.71 on a home worth $200,000 to be exact.

Yep, the Missoula Public Schools will be asking for $158 million so they can upgrade the schools. Great, I’m all for that…mainly because I don’t pay property taxes. But what about those that do? That’s why I left the following comment on that Missoula Independent article:

The Montana Budget and Policy Center had a good look at this back in 2014. For instance, back then “Montana’s low income families” paid “6.4% of their income in taxes,” compared to the 4.7% that the richest Montana families paid.

At the same time, “Montana is one of only a few states that impose income taxes on working families living in poverty,” meaning a “two-parent family with two children” begins paying taxes when they make $12,500 a year.

We “value wealth over work,” meaning we hardly even tax capital gains at all, something we discussed in a post called A Hard Look at Corporate and Individual Income Taxes in Montana.

This policy “favors wealthy Montanans who make money on investments,” not regular working people. Just nine states do that, showing once again that Montana is behind the country, the bankers have their hooks in us, and that our current crop of politicians does not care about you or your family.

Our property taxes in Montana are also lopsided, with everyone paying the same rate. So if you have a beat-up trailer, you pay the same rate as that rich guy on the lake. “Twenty-four states have improved the disparity in the share of income toward taxes,” the center states, and they’ve done that with Earned Income Tax Credits.

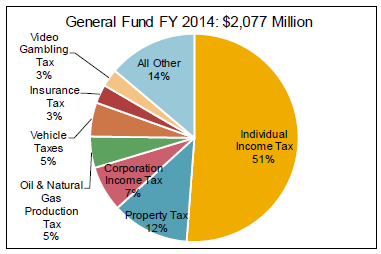

The state wouldn’t have that money anyways, not if it didn’t have a surplus, meaning it’d have to borrow it from the banks or the feds. So it’s important that people own property, as the government would take a serious funding hit without it. Sure, they take in income taxes, but that accounts for just 51% of the state’s general fund.

Of course, who knows if these numbers are accurate? I don’t, and since our sleeping beauties (the state newspapers and TV stations) can’t report on it, and since the government can’t get the information out to save its life, what am I supposed to think? I guess it’s best to just make assumptions and rely on ingrained beliefs when it comes to schools.

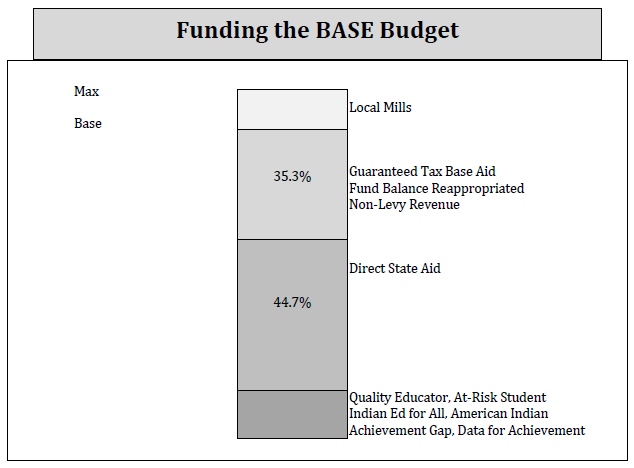

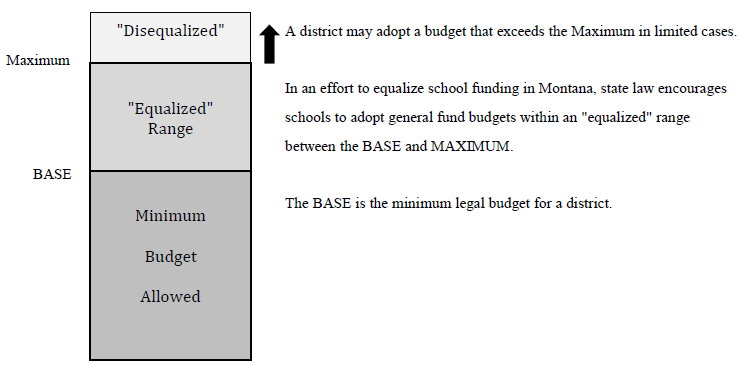

The budget for schools in Montana is called the BASE Budget, which stands for Base Amount for School Equity. This is “the minimum general fund budget that all public school districts must adopt in Montana,” according to the OPI.

All of this meant that the 1989 Montana Legislature had to be called into a special session that June to address the issue, which resulted in the Guaranteed Tax Base System.

The Guaranteed Tax Base System assisted “low wealth districts by subsidizing their tax base through state assistance,” although our current funding model didn’t come about until additional court actions were taken in 1991. By 1998, all of Montana’s school districts were getting the money they needed…or were they?

One of the problems with equitable distribution is that you have to take money from elsewhere to make it happen. That’s why we have so much state funding for K-12 today, because of this equitable funding model.

That’s fine by me, but something that does become burdensome to property tax payers are the “disequalized districts,” which is a district that has an over-maximum budget.

It’s important to remember that “although the trustees control the budget process in a school district, the county commissioners actually levy the required mills for the final budget.”

So if you’d like to know where else to apportion blame for all the increase school taxes, that’s a good place to start. After all, they’re the first line of defense for you, and don’t have to allow things one the ballot. So…who are they working for? Many times it’s not you, the person that’s paying them. Why is that?

History of Montana Mill Levies

Montana has 40 mill levies for local schools, another 33 mill levies for “elementary county equalization,” 22 more for “high school county equalization,” and then 6 more for the university system.

That’s a total of 101 total mill levies for the State of Montana. I find that reprehensible, myself, and a clear sign that they system is not working properly, and hasn’t been for decades! The blame can be placed squarely with the legislature and their failure to create a Montana University System that made even a modicum of sense. Unfortunately, voters have perpetuated that problem.

In 1914 voters were given the chance to consolidate the bloated and multi-campus MUS, but they rejected it in favor of creating two new campuses, though both wouldn’t be completed until the homesteading boom was long gone and their utility became even more questionable than when they were proposed. Northern Montana College in Havre and Eastern Montana Normal College in Billings have been plaguing taxpayers ever since.

“The failure of consolidation meant mounting demands for state revenue,” historian Michael P. Malone writes in Montana: A History of Two Centuries, “which came mainly from the general fund raised by the statewide property tax.”

By 1920 this just wasn’t enough, especially with all that tax money wiped away by the Montana homesteading bust. Voters approved two initiatives that year that changed how tax money was raised for schools, and they did this by creating special mill levies.

In 1930 the voters again approved this strategy, renewing the one-and-a-half mill levy of 1920 for another ten years. By 1940 voters had gotten used to having mill levies around and this time 3.5 mill levies were passed.

Because of the growing strains on Montana’s university system, in 1947 the legislature threw two referendums out to the people to vote on the next November. One of these would give the university system six mill levies to supply its needed funds.

The other would create an infrastructure building bond of $5 million. Both passed by a vote of the people and in 1958 the six-mill levy of the university was passed again. It’s passed every two years since then, and Montana’s have clearly seen the effects in their pocketbooks.

We have too much student loan debt to buy a house. And I’m sorry, but taking on a mortgage while you have a student loan payment is stupid.

Most young people can’t afford to make their monthly minimum on student loans…how are they going to pay the mortgage on top of it? Hell, most aren’t even paying the rent, unless mom and pop are charging them for their old room.

We’ve got problems here, and they’re too many mills and too few paying into them. Oh, maybe people are paying into them now, but they won’t be in 10 or 20 years. I mean, I can’t afford to buy property…so where are the state’s property taxes going to come from, where are the schools’?

Rich transplants, that’s what I figure. It’s good there’s a drought in California – by next summer we’ll have a lot more of those rich assholes moving up here, gating off their land, trying to get away from the mindless hoards of poor refugees.

We already know your kids can’t live here. Sure, they might be like Jon Tester’s kids, working in the local school districts, doing a government job because we’ve pretty much told private industry that this state doesn’t have anything to offer their workers.

So we’re taxing a government job to pay for that government job. How is that sustainable?

It’s not, and the best thing is to not look at it and hope it goes away, or perhaps raise another mill levy and hope tax payers shut the hell up, get back in their place. That’s what our state leaders want.

How’s that working for you?

You Might Also Like

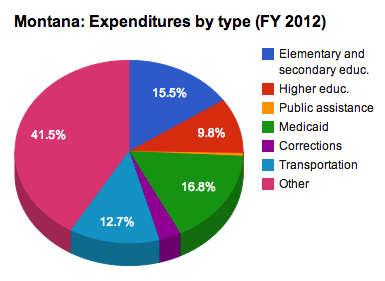

What is Montana Spending Its Money On? (Jan 12, 2015)

Deciphering Montana’s State Special Revenue and General Fund (Jan 14, 2015)