We’ll look at the 67-page FY 2017 Base Budget Report, which was prepared by the Legislative Finance Committee and released on September 29.

We’ll also look at the 179-page Revenue Estimate Recommendations, which covers the years 2017, 2018, and 2019 and was put out by the Legislative Fiscal Division on November 18.

This is dry stuff.

Usually the only people looking at this are being paid to look at it.

It’s their job, and perhaps they see things a little differently than you and I will.

After all, we’re not paid tax dollars to look at this.

In fact, it’s our tax dollars that will be spent in these budgets.

We as regular citizens have almost no say over how this money is spent.

Sure, we can write a letter or go and give testimony, but will we?

Probably not.

Nonetheless, we’ll look at this information because it’s important for regular citizens to see it, not just the taxpayer funded bureaucrats in Helena.

Let’s start with the big, 179-page revenue estimate report.

It’s divided into the following sections:

- Overview

- Business and Personal Taxes

- Natural Resource Taxes

- Interest Earnings

- Consumption Taxes

- Property Taxes

- Other General Fund Revenue

- Guarantee Fund Revenue

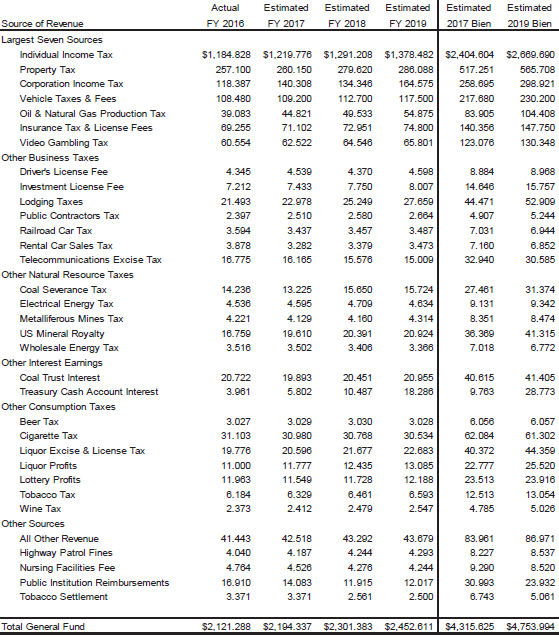

The 7 largest sources of Montana’s estimated 2017 income are:

- Individual Income Tax: $1.21 billion

- Property Tax: $260 million

- Corporate Income Tax: $140 million

- Vehicle Taxes & Fees: $109 million

- Oil & Natural Gas Taxes: $44.8 million

- Insurance Taxes & Licensing Fees: $71 million

- Video Gambling Tax: $62.5 million

Those 7 largest sources of revenue account for $1.89 billion.

Besides that we have a lot of other, smaller revenue sources. You can see those here:

So for the total 2017 General Fund we’ll have $2.19 billion.

If you want to look at the 2017-18 biennium General Fund it’d be $4.31 billion.

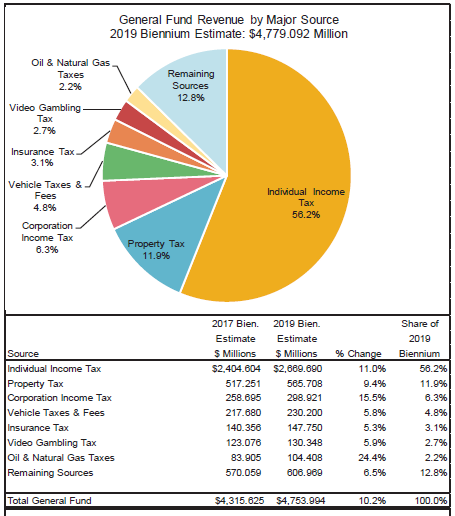

Here’s what that biennium revenue estimate looks like in graph form:

As you can see, in every single area, revenue has gone up.

- For the state, that’s great – more money to fund services.

- For you, however, that’s terrible – less money to spend on things you want.

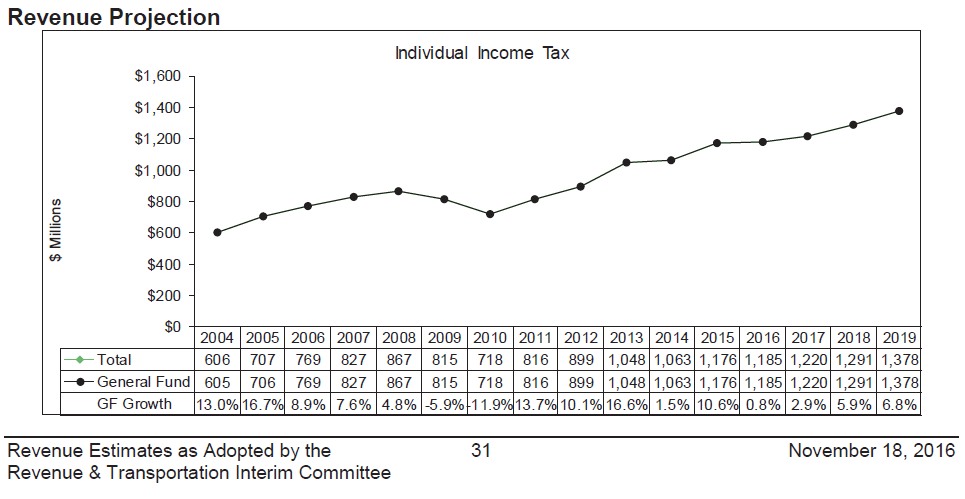

Over just the next two years it’s expected that you’ll be paying 11% more in income taxes, 9% more in property taxes, and nearly 6% more in vehicle taxes and fees.

If you’re a business you’ll be paying 15% more in corporate taxes and 5% more for insurance taxes.

If you like to gamble on the machines you’ll be paying nearly 6% more in taxes. If you drill oil or gas you’ll pay 24% more in taxes.

Why?

Let me ask that one more time…

Why?

Why are Montanans being taxed more…and where is that money going?

To put it another way, why is the state getting so much more revenue if that's not coming from an increase in taxes?

And why do income taxes account for so much of our state's revenue? Is this good...bad...don't matter?

That’s the reason we’re doing this post today, to figure out the answers to those questions.

The big problem is that we have 150 knuckleheads that’ll decide how this money is spent.

We call them legislators. Most don’t know as much as I’ve just told you now.

Despite that, they’ll decide how your tax money is spent.

Again, you’ll have very little say in this – you weren’t going to write a letter or testify, remember?

And that’s why your income taxes will continue to go up year after year.

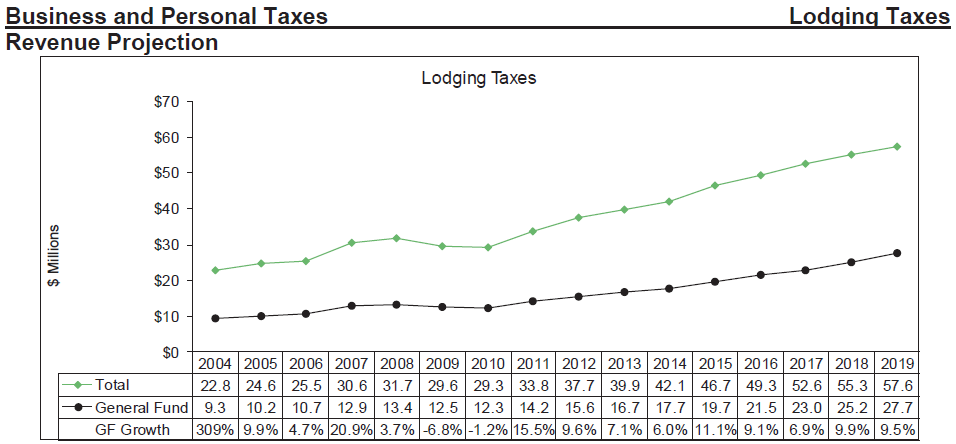

One tax that probably doesn’t have much affect on you is the lodging tax.

This is a 3% tax and it mostly targets hotels, though campgrounds also fall under it.

So for 2017 we’ll have $52 million in revenue from this tax. That’s quite the increase from the nearly $23 million we got in 2004.

65% of this tax revenue goes to the Department of Commerce for tourism promotion.

That really means that a large chunk is going to Wisconsin marketing firms that are friendly with Commerce head Meg O’Leary.

Another 22% of that lodging tax goes to nonprofit tourism corporations, 6% goes to FW&P, 2% goes to the universities for travel research programs, and 1% goes to the Historical Society for historic roadside signs.

I hope legislators will look at this tax, as well as how much is going to our problematic Commerce Department.

Let’s rewrite those percentage allocations so that Commerce (Wisconsin) isn’t getting so much.

Remember, the governor has very little say in this – it’s the legislature that’ll be calling the shots from January to mid-April.

That’s what the monumental Democratic losses around the state meant.

Moving on...we currently have a 3% tax on railroad cars.

I’d like to see this tax go up, and for the simple reason that railroad companies are forcing Montanans to stare at their empty cars as they sit idle and forgotten on tracks all across the state.

We’ll be bringing in $3.4 million of these taxes for 2017.

I’d rather we tax these rich railroads more than we tax struggling workers, but that’s just me.

One argument against this will of course be that we raised the railroad car tax from 2.4% to 3.7% in 2015.

We currently charge a 4% tax on rental cars, another area that doesn’t really affect regular Montanans, just the people that come to visit or do business.

We’ll make $4.3 million from that in 2017.

I kind of like the idea of raising that tax to 5%, but I kind of like the idea of cutting spending in other areas too.

I mean, why do we need to raise taxes all the time? Usually it’s because we don’t have enough money for things we want.

Personally, I feel we should break out the fine-toothed comb and go through those things we want to see if we can cut costs somewhere.

Agencies might cry foul, and we should let them. The vast majority of Montanans won’t be listening.

Our telecommunications excise tax is 3.75% and we’re losing money here compared to previous years.

For 2017 we’ll make $16 million. In 2007 we made $21 million.

The main reason for this was that the Department of Revenue lost a pre-paid wireless case in 2011 that’s been reducing revenues by about $1 million a year since then.

We have two options here – live with the revenue reduction while cutting spending in other areas, or increase revenue through current or new taxes.

Something that legislators might want to consider is a 1% to 2% tax on drones while it's still early and there are few to decry it.

Or we could just cut spending. It’s what most Montanans do when it comes to their household budgets. Sometimes they go out and get new revenue through an additional job, but mostly they just cut spending.

We’re currently 60 pages into the 179-page revenue estimate.

Want to keep going?

I don’t blame you if you don’t – this is dry stuff!

Let me just mention a few more things that I’ve noticed:

I also see that we’re bringing in $76 million in diesel taxes, $152 million in gas taxes, and another $35 million in gross vehicle weight and other fees.

We call those consumption taxes and they take $263 million from our pocket each year.

That’s not something people want to pay, especially when the consumer price index is set to go up by 1% in 2017 and that after a 1% increase last year.

When that index goes up, prices for goods increase and you have less money in your pocket.

We’ll see if our corporate tax rate is sustainable. Pre-tax profits for U.S. corporations are set to go up 4% in 2017 from the previous year, then they’ll fall 2% in 2018 and then 3% in 2019. By that final year, corporate pre-tax profits will be at 0%.

Alright, let’s switch over to the shorter report.

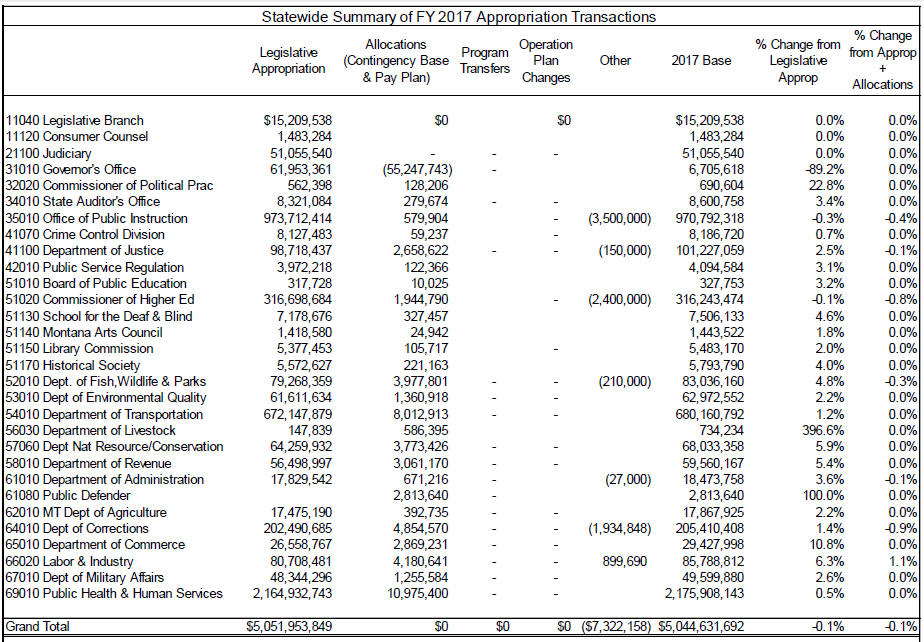

One thing that jumps out at me is this chart showing how much money each agency/office of Montana state government is getting:

You can see where most of the money is going:

- DPHHS: $2.1 billion

- OPI: $973 million

- DOT: $672 million

- Commissioner of Higher Ed.: $316 million

- Corrections: $202 million

- Justice: $98 million

- Labor & Industry: $80 million

- FW&P: $79 million

That chart would be a good one to make a graph out of – maybe a smart reporter will do that (I know it’ll get a bunch of social media shares).

All told, we’re giving $5 billion to our state agencies and offices for 2017, and that’s coming from four main sources:

- Federal Special Revenue: $2.3 billion

- General Fund: $1.9 billion

- State Special Revenue: $755 million

- Proprietary Funds: $12 million

Thank God for the feds, huh?

The legislative branch gets $15 million for 2017. That’ll ensure the legislature can meet and do what it does.

The Governor’s Office is getting nearly $62 million for it’s funding.

Big ticket items in the governor’s office include:

- $46 million for personal services

- $11 million for operating expenses

- $403,000 for Mental Disabilities Bd Visitors

- $330,000 for air transportation

- $286,000 for the Lieutenant Governor’s Office

- $188,000 for Indian Affairs

- $149,000 to operate the governor’s mansion

These numbers can be awfully misleading, however. For instance, when it comes to the lieutenant governor’s office, it takes just $24,000 to operate the place. The other $286,000 goes to personal services, which I think mainly means paychecks for some of the state’s top earners.

Please, don’t ask me what anyone in the lieutenant governor’s office actually does, or how it makes our state better, or your life better.

I don’t know.

Does anyone?

The same goes for the “executive office program,” which takes just $676,000 to operate but spends $1.9 million on personal services…again, whatever the hell those are.

After that the report goes into each state department and what they’re spending money on.

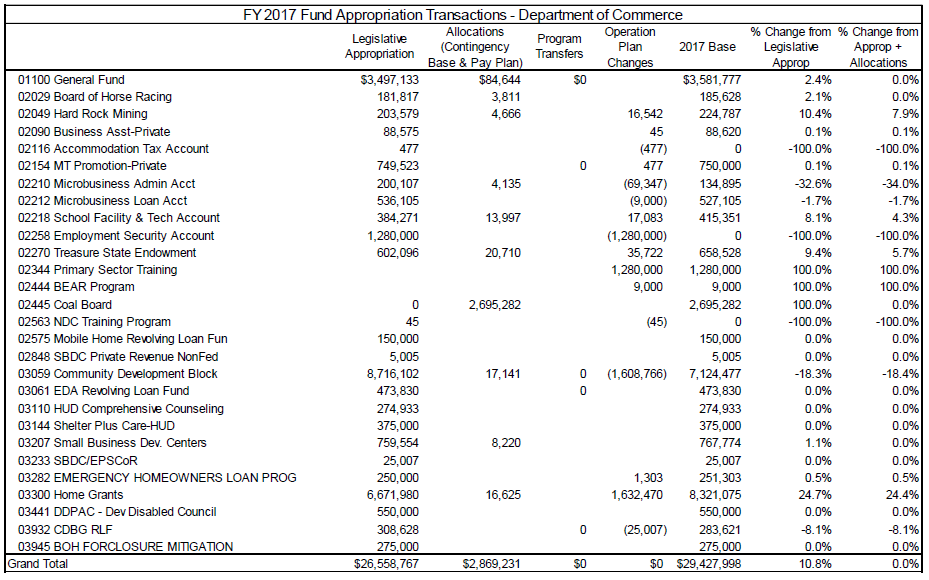

For instance, this is what the Department of Commerce’s funding looks like:

That’s $26 million of your money that’s being spent, and you can see how it’s being spent.

Good luck figuring out what a lot of those things mean, however.

CDBG RLF…SBDC/EPSCoR…BEAR Program…I have no idea what any of those are.

Hopefully people in state government do.

And hey, hopefully some of our legislators do too.

I know that all 150 of them aren’t going to know this stuff, and I’d say that 75 of them probably aren’t.

No, it’ll be a few dozen that are getting the real work done, as it always is.

Most of the rest will down be at the Wind Bag till late in the evenings, then they’ll come into their morning committee meetings all hungover.

That’s the legislature, as it’s always been.

I’ll get there one day, as will other young Montanans, most of whom you haven’t even heard of yet.

Many won’t know a thing, but some of us will be ready.

Until then, I hope you enjoyed reading a bit of what these reports contain.

It’s your money, after all.

And I hope that some of our TV stations and newspapers will do the same as I’ve just done.

Until then, remember…if you want in-depth Montana reporting (that doesn’t cost you a penny), come to Big Sky Words.