I graduated from the University of Montana in May 2008. I’m not sure how much money I had racked up in student loan debt at that point, but it’s a safe bet it was around $31,000. Honestly, I didn’t want to know.

That was a lot higher than average, back then. Around that time the average debt was probably closer to $25,000 or so, though now the average student loan debt has risen up past $30,000.

So I had some loans, but didn’t set about to pay them off. You see, I was still in student-mode, which means you think little about the future and more about wish-fulfillment and living in the moment.

That first year, 2008-2009, I didn’t make any payments. I think my mom got a few letters from the Student Assistance Foundation (SAF), saying that my interest was going to capitalize. She was nice enough to pay that interest for me.

By the time 2009-2010 rolled around, I was making about $950 a month. I deferred my student loans again, but also started to make some modest payments. And when I say modest, I mean like $50 to $100 a month…if even that. The payments were so low that they didn’t even cover all the interest I was accruing.

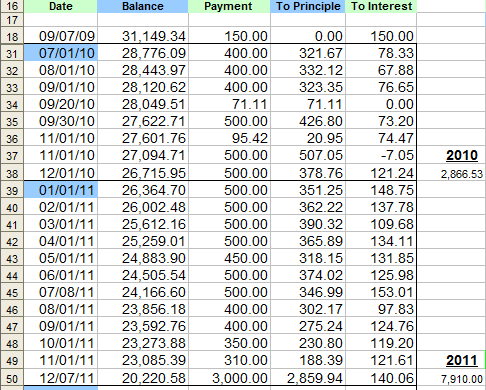

It was in September of 2009 that I started my student loan spreadsheet, which tracks all my payments and interest and all the rest of it. On that first day I made a payment of $150, and all of it went toward interest. At that point I had $31,149.34 in student loan debt and I was making around $10,000 a year.

That’s something most students don’t understand when they take out loans, or are going to school – interest sucks. It adds up and when you make payments, it can eat up a lot. My mom says this interest is good because you can deduct it on your taxes. Yeah, I guess…but it sure doesn’t feel that way when you’re paying it.

That’s one thing you have to realize – parents help out a lot with student loan debt. My mom and dad give me a few bucks here and there for student loans to this day. In that regard, parents never stop spending on education.

When my son Paul was born in 2011 my wife stopped working and I drastically reduced those student loan payments each month. The highest amount I paid in 2012 was $250 and most months it was closer to $150. By the end of the year I was only down to $19,619.30.

This is another dirty little secret that many students won’t realize. You can pay a lot each year or each month, but if you’re just paying interest, you’re not going anywhere. It’s spinning your wheels in the mud. For 2012 I made $1,775 in student loan payments, but my principle balance only decreased by $564.63. That means 65% of my payments that year went to interest alone – I was going nowhere.

I upped my payments a lot more in 2013. In 2014 I also got some more help from my mom, $3,500 in fact. My dad also chipped in about $500 one year. It turned out to be a pretty good year, with more than $4,400 going to the principle balance and just over $800 going to interest.

I got motivated again this year, and started making higher payments. My latest tactic has been to convince my parents to match me on payments, typically large ones. So last month I paid $750 and my mom paid $750, for instance.

I don’t know how else to get rid of these damn things. I could get another job, I suppose. Right now I just funnel all extra money to the student loans. I have no savings and I never buy clothes. It’s just right into the student loans.

Why do this? Well, I’d like to start saving for a house one day, and hopefully before I turn 35 in two years. If I’m lucky I might have enough for a good down payment by the time I’m 37 or 38. The goal is to get into one before I’m 40.

So that’s where I’m at and that’s where countless other people my age are at. My student loans are now down to $11,803.26. Since I started paying them off I’ve paid more than $22,000 to the principle balance and more than $5,100 to interest.

My greatest fear at this point isn’t not paying off my student loans, it’s that others won’t have to.

As you saw, I’ve already paid off more than $22,000 and have about $11,000 to go. I’ll get there, but what about that guy with $100,000 in debt and an Art degree? Or what about that doctor with $250,000? Those people might get jobs that allow them to make their payments, but those payments might just be against the interest. In other words, those people will pay for years and go nowhere.

I hate to think that I’ll get my loans paid off but then the entitled millenials will convince the fools in Washington to forgive their debt. I suppose something like that will come along eventually, as our system is unsustainable. It sure won’t make me feel good, however, especially after having paid mine off.

So I’m doing pretty good. I’m lucky I have parents that help me out. No one else does. I will say that Pell Grants helped me a lot, and that’s one of the reasons I waited until I was 24-years-old before taking out student loans. At that point I didn’t have to claim my parent’s income, and that put my in the prime Pell Grant category. I got thousands of dollars for free, and if that weren’t the case I’d have about $10,000 more in debt right now.

Conclusion

Student loans cause people in this country to lose hope. They sap our economic muscle and put us at a competitive disadvantage compared to other countries. They do enrich a small crust of banking and Wall Street elite, so I guess there’s that. Overall, I feel they create more misery than they’re worth, and I’ll encourage my son not to go to college because of it. The library’s cheaper, and all the jobs in Montana don’t pay anyways.

We have a broken system, and it’s going to ruin a lot of lives. It already has, but it’ll get a lot worse. Just wait – you’ll see it because the problem isn’t a priority. It’ll fester and grow and one day it’ll blow up. Watch out – it’ll be messy.