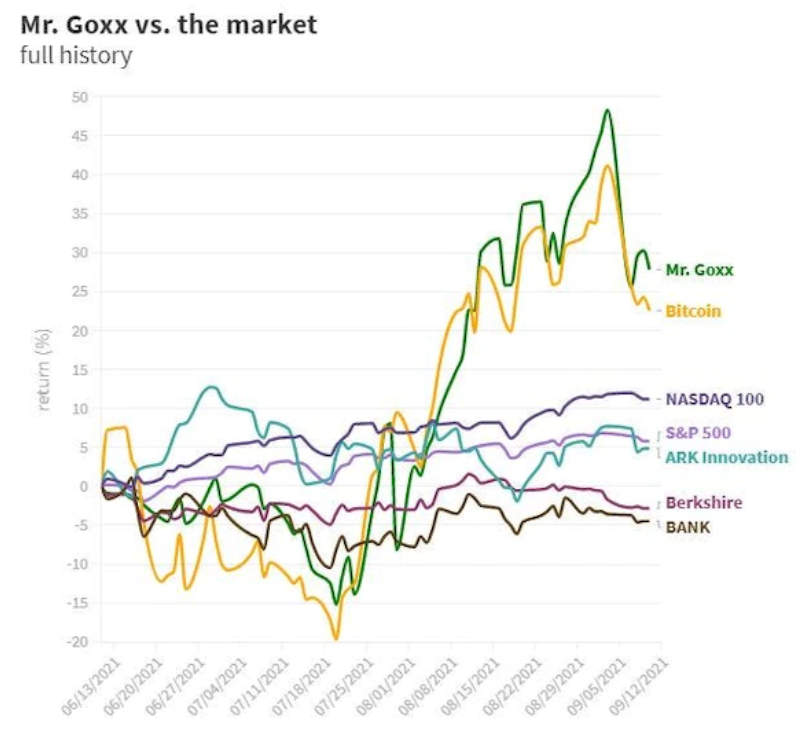

The livestreamed hamster, named Mr. Goxx, has been independently trading a portfolio of various cryptocurrencies since June 12, and so far its performance has been impressive. As of Friday, the portfolio was up nearly 24%, according to the @mrgoxx twitter feed that documents daily performance, along with every trade made by the hamster. Mr. Goxx's performance outpaces bitcoin and the S&P 500 over the same time period.

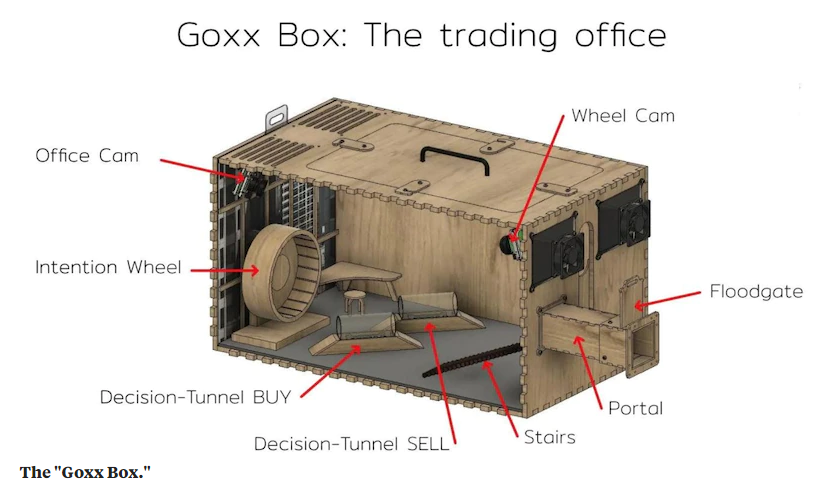

Mr. Goxx's caretaker built the "Goxx Box," a crypto-rigged office attached to its larger home that gives the hamster the ability to perform various exercises that then execute specific cryptocurrency trades. The hamster can enter its office whenever it wants to make trades.

First, Goxx runs on the "intention wheel" to pick which one of about 30 cryptocurrencies to trade. Once the crypto is chosen, the hamster runs through one of two "decision tunnels" that trigger either a buy or sell trade of the chosen cryptocurrency.

The top cyptocurrencies currently held by the hamster include Tron, Ripple's XRP, cardano's ada, and ether.

Goxx's portfolio was funded with the euro equivalent of $390, according to a report from Protos. Mr. Goxx's unidentified caretaker and business partner told Protos that the trades the hamster makes are automatically set to 20 euro increments.

"There are plans to give Mr. Goxx more control and let him intentionally pick his buy amount if the interest in his channel keeps growing," the business partner told Protos.

Mr. Goxx has so far generated profits of 77 euros as of Friday afternoon. Its portfolio hit a high of nearly $580 in mid-September, when its performance was up nearly 50% in less than three months, according to performance data compiled by Protos. But since then, the recent crypto sell-off put a dent into the hamster's profits.

But a profit is a profit, and Mr. Goxx likely understands that. "Mr. Goxx is happy to see that some of his investments finally pay off," the business partner told Protos.

Note:

I love this story. I think it’s a good illustration of how dysfunctional our economy is. It reminds me of the old Joe Kennedy story.

How did he do it? There is a famous anecdote about Joe and while he was trading stocks during the Roaring 20s. Markets were SPIKING. Money was flowing. But, days before the crash, a certain moment lead Joe to sell everything at the highs and hold his cash. In 1996, the writer John Rothchild wrote a piece called “When The Shoeshine Boy Talks” and he says:

“Joe Kennedy exited the stock market in timely fashion after a shoeshine boy gave him some stock tips. He figured that when the shoeshine boys have tips, the market is too popular for its own good.”

The story continues:

“A theory also advanced by Bernard Baruch, another vested interest who described the scene before the big Crash: “Taxi drivers told you what to buy. The shoeshine boy could give you a summary of the day’s financial news as he worked with rag and polish. An old beggar who regularly patrolled the street in front of my office now gave me tips and, I suppose, spent the money I and others gave him in the market. My cook had a brokerage account and followed the ticker closely. Her paper profits were quickly blown away in the gale of 1929.” – Fortune Magazine, When Shoeshine Boys Talk Stocks

I sold all my stocks months ago. I have absolutely no confidence in the markets. Many can’t sell. So many are locked-in. Others don’t know what to do with their money if it’s not in the markets.

I think many will wish they had a safe or a mattress or even a sock drawer to sock it away in. The longer the Fed holds off on the correction/panic/depression...the worse it’ll be.

But who am I to talk? I’ve got thousands in crypto right now, in coins you’ve never heard of. Tezos, Theta, Tron, Cardano, Ox, XRP, EOS, OMG.

I’ve got 1,000 Zilliqa coins. That might sound impressive, until you realize each of them is worth 8 cents.

What the hell is Zillqa, you might ask?

Zilliqa is the world's first high-throughput public blockchain platform - designed to scale to thousands of transactions per second. Zilliqa brings the theory of sharding to practice with its novel protocol that increases transaction rates as its network expands. The platform is tailored towards enabling secure data-driven decentralised apps, designed to meet the scaling requirements of machine learning and financial algorithms.

Wow, that’s some good bullshit. Whoever wrote that must have a Ph.D. in bullshitting.

But that’s a lot of what crypto investing is. Personally, I think it’s a lot more honest than Wall Street is. At least with crypto, you know you’ll probably get fucked. Wall Street pretends you won’t, but at this point, I don’t think there’s much difference between the two.

Joe Kennedy. The shoeshine boy. What the hell has changed?