MT License Plates, 1970-2010

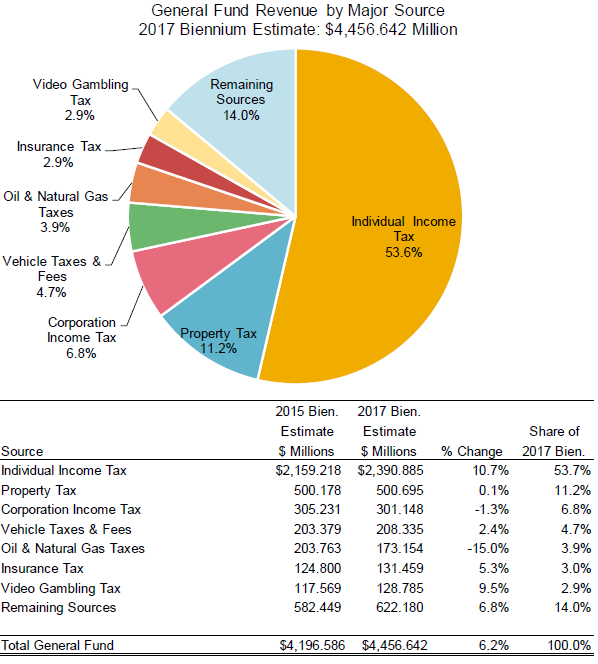

MT License Plates, 1970-2010 The General Fund is the main funding source for state government, and we need to figure out where that money is going. We also need to figure out where that money is coming from.

You’ll remember that earlier in the week we explored Montana’s budget and income sources and what it’s spending its money on. Here’s the complete list so you can stay caught-up with us:

I’ll be taking that information and bundling it together with more information into a book called Montana: A Modern Look. Why? Because I’m smarter than you, and I have an agenda.

This is what the legislature is talking about, and this is what you need to know. The time of living in ignorance and letting rich white men decide your fate is over. With the articles that appear on this site, you’ll know more than those clowns. Now the question is, how will you use that information, powerful as it is?

It’s tough to look at financials and graphs and try to make sense of it. It’s much easier to dig up dirt and talk about fluff. That’s what you’ve come to expect from Montana political websites, and I’m sorry.

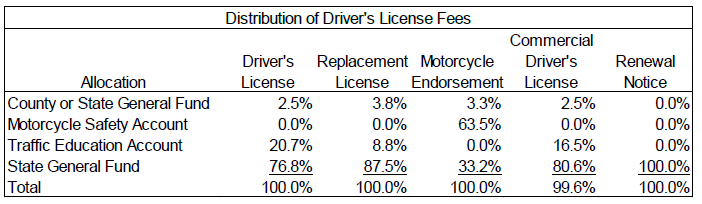

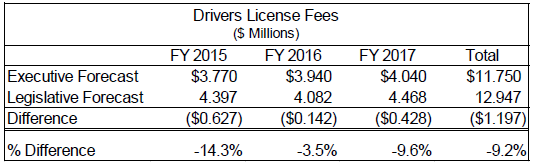

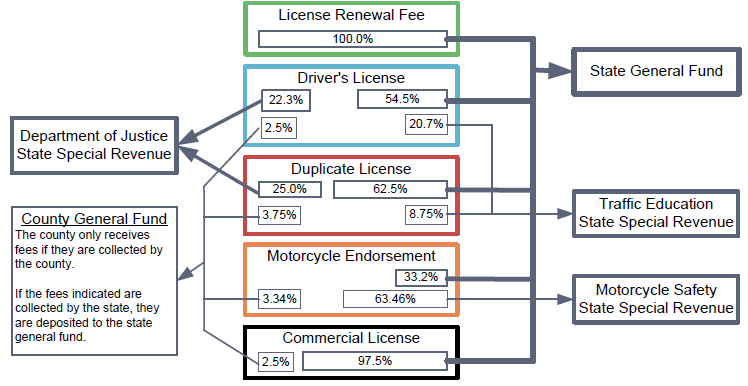

Driver’s License Fees in Montana

One reason Montana is losing money is because of the ages of drivers. Our license fees are based on age, and youth driving habits affect that. Here’s how these breakdown:

- Driver’s License: $5 per year;

- Motorcycle Endorsement: $0.50 per year;

- Commercial Driver’s License, Interstate: $10 per year;

- Commercial Driver’s License, Intrastate: $8.50 per year;

- Duplicate License: $10

- Renewal Notice: $0.50

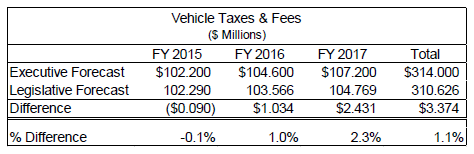

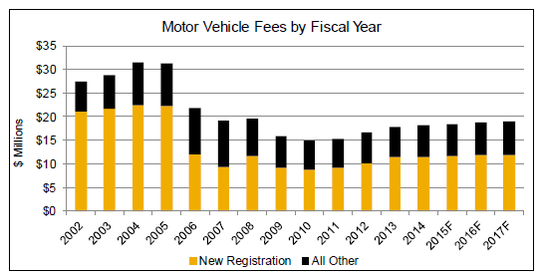

Motor Vehicle Fee in Montana

- Registration Fees;

- Record Liens Type 1;

- Record Liens Type 2;

- Title Fees;

- Personal and New Plate Fees;

- Senior Transit Fee;

- Veteran’s Administration Fees;

- Miscellaneous Fees.

It’s important to remember that this money is divided 96.6% to the General Fund and 3.4% to State Special Revenue. We explored that breakdown more fully in a post called Deciphering Montana’s State Special Revenue and General Fund.

$10 million down the drain here folks, and the reason was SB 285 and HB 671 that got through in 2005. Right? Maybe not. What did those bills do? They reduced fees and also reclassified many fees under the vehicle tax revenue. According to our report, that caused net revenue to change by zero. We’ll see this later on.

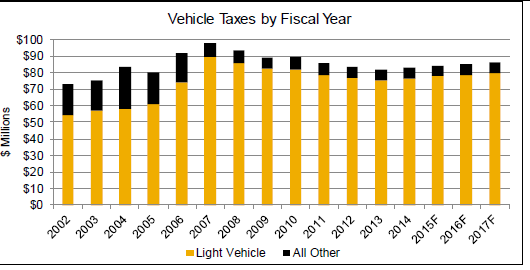

Vehicle Tax in Montana

This set of vehicle taxes in Montana covers five different categories, which are determined by age and weight of the vehicle:

- Light Vehicles;

- Large Trucks;

- Motor Homes;

- Motorcycles;

- Boats & Snowmobiles.

Here’s what the income looks like:

Are vehicles a way for Montana to get more money? I don’t think so, but it is a good area to look at to see something that should probably remain the same. Nope, if we want to make this state better, we need to look for another area to cut or increase.

Check back later for a look at corporate taxes and individual income taxes in Montana! And later in the week we’ll explore alternate revenue options that aren’t in the current budget, such as a sales tax, marijuana taxes and tourist taxes.

Thanks for reading…and paying taxes!