A peek at what they’ve got planned can be found in the Missoulian under a section called taxes. This is what we know:

- On Tuesday, January 20, HB 169 will be heard in the House Taxation Committee. The bill aims to reduce state income taxes by 5%, which is $79 million.

- At the same time, HB 166 will be heard, which aims to “slightly reduce” state income tax-rates. This means $26 million in taxes will be cut.

- Sometime that same day HB 159 is being heard by the House Taxation Committee. This bill aims to allow residents 65-years-old and up to be limited in how much property tax increases they can shoulder.

- On Wednesday, SB 116 is going to be heard in the Senate Taxation Committee. This bill aims to increase the tax credit elderly homeowners can get, from $1,000 to $1,500.

That’s quite a lot of stuff going on there, huh? First, we know the nutcases that know nothing about Montana finances are trying to push through the tax cuts. Both plans are terrible, and I won’t even try to say taking the $26 million cut is better – it’s not, because we have no idea how to make up that revenue. Remember, these two jokers don’t think long-term, just what will benefit their bank account.

On the other side, it seems that we have some responsible dealings with Rep Frank Garner (R-Kalispell) and Sen. Brian Hover (R-Great Falls). They’re trying to help old folks out, and that’s not a bad idea. I like their approach a lot better than the other clowns’.

How does this benefit me? If I’m living in poverty it doesn’t benefit me at all, because that’s such a miniscule amount. But if you’re pulling in the dough, then I bet that adds up. How much dough did Regier pull in last year, that’ll tell you if you should support this or not. And remember, Regier thinks it's fine to increase taxes on electric vehicles.

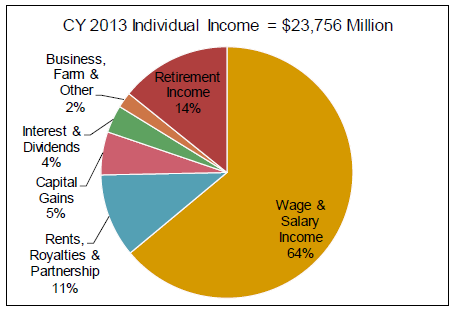

I don’t support it, because it’s stupid. Now if Regier would like to talk about increasing our Capital Gains tax or our Interest & Dividends tax, perhaps offsetting some of that Individual Income Tax that’s being cut, I’m all ears. But that wouldn’t benefit him, so he doesn’t want to talk about it.

Can you already see what the signs in the Capitol hallways should read?

Or did you want to make up that extra $500 tax cut for every senior citizen another way? And the income tax cuts? Because that money doesn’t just appear out of nowhere. What ideas do you have to replace that on the books?

None? Well, why should I even listen to your proposal to change our current tax structure then? If you want those scales of justice to remain balanced, you’ve got to give and take. Where are you going to take?

Don’t ask – these Republicans don’t know.

And the income tax issue? That doesn’t benefit me either. That makes it harder for the state to operate, and the state can barely do it’s job now. The state sucks, actually. They can’t attract good businesses here because they never fund 21st century infrastructure. Instead they want to keep us in the Dark Ages of fossil fuels.

Montanans want to do so much more!

Look at me, I make all my money on the computer, and that’s money coming from out of state and sometimes out of country! It comes from Montana hardly ever.

Don’t we want that, isn’t that the ideal in an economy? Then why don’t we push for that?

I guess because we want to keep our people in a state of subsistence-level living and service-industry servitude. It’s bondage, plain and simple, and if you can’t see the chains binding our wrists and ankles, you can certainly hear them rattling, a pocketful of change guarantees that.

It’s a sad state of affairs we’ve got here right now, and you can see that the policies brought forth and then pushed by the ruling classes are doing nothing for you and your family. If anything they’re driving you and your family away.

I just don’t understand who’s going to tell the tourists where to go when they ask for directions. But then I guess when all the 3rd and 4th generation Montanans have been driven out, all the good spots won’t be spoiled anymore.